How The Internet Happened: From Netscape to the iPhone

Brian McCullough, who runs Internet History Podcast, also wrote a book named How The Internet Happened: From Netscape to the iPhone which did a fantastic job of capturing the ethos of the early web and telling the backstory of so many people & projects behind it’s evolution.

I think the quote which best the magic of the early web is

Jim Clark came from the world of machines and hardware, where development schedules were measured in years—even decades—and where “doing a startup” meant factories, manufacturing, inventory, shipping schedules and the like. But the Mosaic team had stumbled upon something simpler. They had discovered that you could dream up a product, code it, release it to the ether and change the world overnight. Thanks to the Internet, users could download your product, give you feedback on it, and you could release an update, all in the same day. In the web world, development schedules could be measured in weeks.

The part I bolded in the above quote from the book really captures the magic of the Internet & what pulled so many people toward the early web.

The current web – dominated by never-ending feeds & a variety of closed silos – is a big shift from the early days of web comics & other underground cool stuff people created & shared because they thought it was neat.

Many established players missed the actual direction of the web by trying to create something more akin to the web of today before the infrastructure could support it. Many of the “big things” driving web adoption relied heavily on chance luck – combined with a lot of hard work & a willingness to be responsive to feedback & data.

- Even when Marc Andreessen moved to the valley he thought he was late and he had “missed the whole thing,” but he saw the relentless growth of the web & decided making another web browser was the play that made sense at the time.

- Tim Berners-Lee was dismayed when Andreessen’s web browser enabled embedded image support in web documents.

- Early Amazon review features were originally for editorial content from Amazon itself. Bezos originally wanted to launch a broad-based Amazon like it is today, but realized it would be too capital intensive & focused on books off the start so he could sell a known commodity with a long tail. Amazon was initially built off leveraging 2 book distributors ( Ingram and Baker & Taylor) & R. R. Bowker’s Books In Print catalog. They also did clever hacks to meet minimum order requirements like ordering out of stock books as part of their order, so they could only order what customers had purchased.

Amazon employees:

2018 647,500

2017 566,000

2016 341,400

2015 230,800

2014 154,100

2013 117,300

2012 88,400

2011 56,200

2010 33,700

2009 24,300

2008 20,700

2007 17,000

2006 13,900

2005 12,000

2004 9000

2003 7800

2002 7500

2001 7800

2000 9000

1999 7600

1998 2100

1997 614

1996 158— Jon Erlichman (@JonErlichman) April 8, 2019 - eBay began as an /aw/ subfolder on the eBay domain name which was hosted on a residential internet connection. Pierre Omidyar coded the auction service over labor day weekend in 1995. The domain had other sections focused on topics like ebola. It was switched from AuctionWeb to a stand alone site only after the ISP started charging for a business line. It had no formal Paypal integration or anything like that, rather when listings started to charge a commission, merchants would mail physical checks in to pay for the platform share of their sales. Beanie Babies also helped skyrocket platform usage.

- The reason AOL carpet bombed the United States with CDs – at their peak half of all CDs produced were AOL CDs – was their initial response rate was around 10%, a crazy number for untargeted direct mail.

- Priceline was lucky to have survived the bubble as their idea was to spread broadly across other categories beyond travel & they were losing about $30 per airline ticket sold.

- The broader web bubble left behind valuable infrastructure like unused fiber to fuel continued growth long after the bubble popped. The dot com bubble was possible in part because there was a secular bull market in bonds stemming back to the early 1980s & falling debt service payments increased financial leverage and company valuations.

- TED members hissed at Bill Gross when he unveiled GoTo.com, which ranked “search” results based on advertiser bids.

- Excite turned down offering the Google founders $1.6 million for the PageRank technology in part because Larry Page insisted to Excite CEO George Bell ‘If we come to work for Excite, you need to rip out all the Excite technology and replace it with [our] search.’ And, ultimately, that’s—in my recollection—where the deal fell apart.”

- Steve Jobs initially disliked the multi-touch technology that mobile would rely on, one of the early iPhone prototypes had the iPod clickwheel, and Apple was against offering an app store in any form. Steve Jobs so loathed his interactions with the record labels that he did not want to build a phone & first licensed iTunes to Motorola, where they made the horrible ROKR phone. He only ended up building a phone after Cingular / AT&T begged him to.

- Wikipedia was originally launched as a back up feeder site that was to feed into Nupedia.

- Even after Facebook had strong traction, Marc Zuckerberg kept working on other projects like a file sharing service. Facebook’s news feed was publicly hated based on the complaints, but it almost instantly led to a doubling of usage of the site so they never dumped it. After spreading from college to college Facebook struggled to expand ad other businesses & opening registration up to all was a hail mary move to see if it would rekindle growth instead of selling to Yahoo! for a billion dollars.

The book offers a lot of color to many important web related companies.

And many companies which were only briefly mentioned also ran into the same sort of lucky breaks the above companies did. Paypal was heavily reliant on eBay for initial distribution, but even that was something they initially tried to block until it became so obvious they stopped fighting it:

“At some point I sort of quit trying to stop the EBay users and mostly focused on figuring out how to not lose money,” Levchin recalls. … In the late 2000s, almost a decade after it first went public, PayPal was drifting toward obsolescence and consistently alienating the small businesses that paid it to handle their online checkout. Much of the company’s code was being written offshore to cut costs, and the best programmers and designers had fled the company. … PayPal’s conversion rate is lights-out: Eighty-nine percent of the time a customer gets to its checkout page, he makes the purchase. For other online credit and debit card transactions, that number sits at about 50 percent.

Here is a podcast interview of Brian McCullough by Chris Dixon.

How The Internet Happened: From Netscape to the iPhone is a great book well worth a read for anyone interested in the web.

How The Internet Happened: From Netscape to the iPhone

Brian McCullough, who runs Internet History Podcast, also wrote a book named How The Internet Happened: From Netscape to the iPhone which did a fantastic job of capturing the ethos of the early web and telling the backstory of so many people & projects behind it’s evolution.

I think the quote which best the magic of the early web is

Jim Clark came from the world of machines and hardware, where development schedules were measured in years—even decades—and where “doing a startup” meant factories, manufacturing, inventory, shipping schedules and the like. But the Mosaic team had stumbled upon something simpler. They had discovered that you could dream up a product, code it, release it to the ether and change the world overnight. Thanks to the Internet, users could download your product, give you feedback on it, and you could release an update, all in the same day. In the web world, development schedules could be measured in weeks.

The part I bolded in the above quote from the book really captures the magic of the Internet & what pulled so many people toward the early web.

The current web – dominated by never-ending feeds & a variety of closed silos – is a big shift from the early days of web comics & other underground cool stuff people created & shared because they thought it was neat.

Many established players missed the actual direction of the web by trying to create something more akin to the web of today before the infrastructure could support it. Many of the “big things” driving web adoption relied heavily on chance luck – combined with a lot of hard work & a willingness to be responsive to feedback & data.

- Even when Marc Andreessen moved to the valley he thought he was late and he had “missed the whole thing,” but he saw the relentless growth of the web & decided making another web browser was the play that made sense at the time.

- Tim Berners-Lee was dismayed when Andreessen’s web browser enabled embedded image support in web documents.

- Early Amazon review features were originally for editorial content from Amazon itself. Bezos originally wanted to launch a broad-based Amazon like it is today, but realized it would be too capital intensive & focused on books off the start so he could sell a known commodity with a long tail. Amazon was initially built off leveraging 2 book distributors ( Ingram and Baker & Taylor) & R. R. Bowker’s Books In Print catalog. They also did clever hacks to meet minimum order requirements like ordering out of stock books as part of their order, so they could only order what customers had purchased.

- eBay began as an /aw/ subfolder on the eBay domain name which was hosted on a residential internet connection. Pierre Omidyar coded the auction service over labor day weekend in 1995. The domain had other sections focused on topics like ebola. It was switched from AuctionWeb to a stand alone site only after the ISP started charging for a business line. It had no formal Paypal integration or anything like that, rather when listings started to charge a commission, merchants would mail physical checks in to pay for the platform share of their sales. Beanie Babies also helped skyrocket platform usage.

- The reason AOL carpet bombed the United States with CDs – at their peak half of all CDs produced were AOL CDs – was their initial response rate was around 10%, a crazy number for untargeted direct mail.

- Priceline was lucky to have survived the bubble as their idea was to spread broadly across other categories beyond travel & they were losing about $30 per airline ticket sold.

- The broader web bubble left behind valuable infrastructure like unused fiber to fuel continued growth long after the bubble popped. The dot com bubble was possible in part because there was a secular bull market in bonds stemming back to the early 1980s & falling debt service payments increased financial leverage and company valuations.

- TED members hissed at Bill Gross when he unveiled GoTo.com, which ranked “search” results based on advertiser bids.

- Excite turned down offering the Google founders $1.6 million for the PageRank technology in part because Larry Page insisted to Excite CEO George Bell ‘If we come to work for Excite, you need to rip out all the Excite technology and replace it with [our] search.’ And, ultimately, that’s—in my recollection—where the deal fell apart.”

- Steve Jobs initially disliked the multi-touch technology that mobile would rely on, one of the early iPhone prototypes had the iPod clickwheel, and Apple was against offering an app store in any form. Steve Jobs so loathed his interactions with the record labels that he did not want to build a phone & first licensed iTunes to Motorola, where they made the horrible ROKR phone. He only ended up building a phone after Cingular / AT&T begged him to.

- Wikipedia was originally launched as a back up feeder site that was to feed into Nupedia.

- Even after Facebook had strong traction, Marc Zuckerberg kept working on other projects like a file sharing service. Facebook’s news feed was publicly hated based on the complaints, but it almost instantly led to a doubling of usage of the site so they never dumped it. After spreading from college to college Facebook struggled to expand ad other businesses & opening registration up to all was a hail mary move to see if it would rekindle growth instead of selling to Yahoo! for a billion dollars.

The book offers a lot of color to many important web related companies.

And many companies which were only briefly mentioned also ran into the same sort of lucky breaks the above companies did. Paypal was heavily reliant on eBay for initial distribution, but even that was something they initially tried to block until it became so obvious they stopped fighting it:

“At some point I sort of quit trying to stop the EBay users and mostly focused on figuring out how to not lose money,” Levchin recalls. … In the late 2000s, almost a decade after it first went public, PayPal was drifting toward obsolescence and consistently alienating the small businesses that paid it to handle their online checkout. Much of the company’s code was being written offshore to cut costs, and the best programmers and designers had fled the company. … PayPal’s conversion rate is lights-out: Eighty-nine percent of the time a customer gets to its checkout page, he makes the purchase. For other online credit and debit card transactions, that number sits at about 50 percent.

Here is a podcast interview of Brian McCullough by Chris Dixon.

How The Internet Happened: From Netscape to the iPhone is a great book well worth a read for anyone interested in the web.

Google Florida 2.0 Algorithm Update: Early Observations

It has been a while since Google has had a major algorithm update.

They recently announced one which began on the 12th of March.

This week, we released a broad core algorithm update, as we do several times per year. Our guidance about such updates remains as we’ve covered before. Please see these tweets for more about that:https://t.co/uPlEdSLHoXhttps://t.co/tmfQkhdjPL— Google SearchLiaison (@searchliaison) March 13, 2019

What changed?

It appears multiple things did.

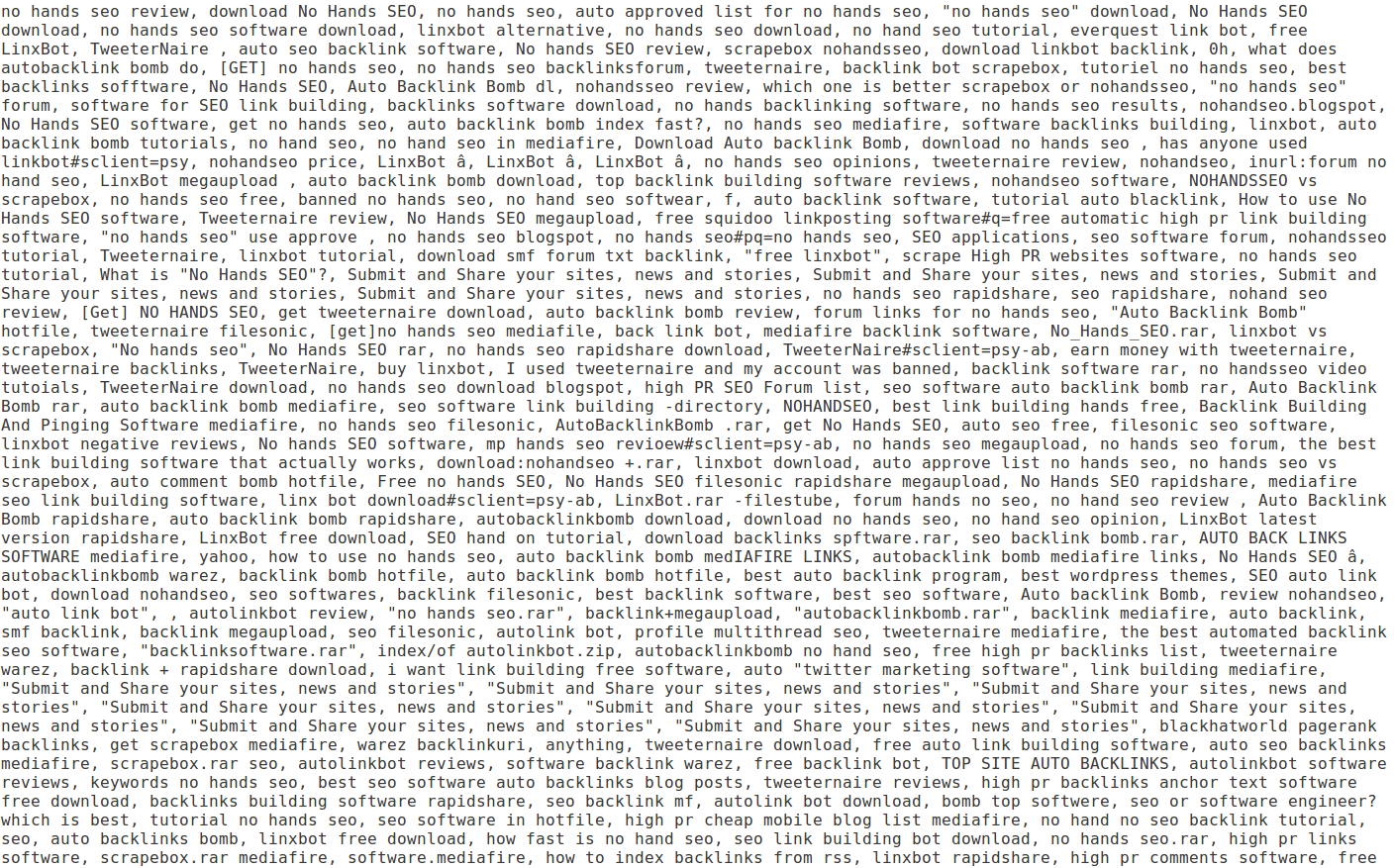

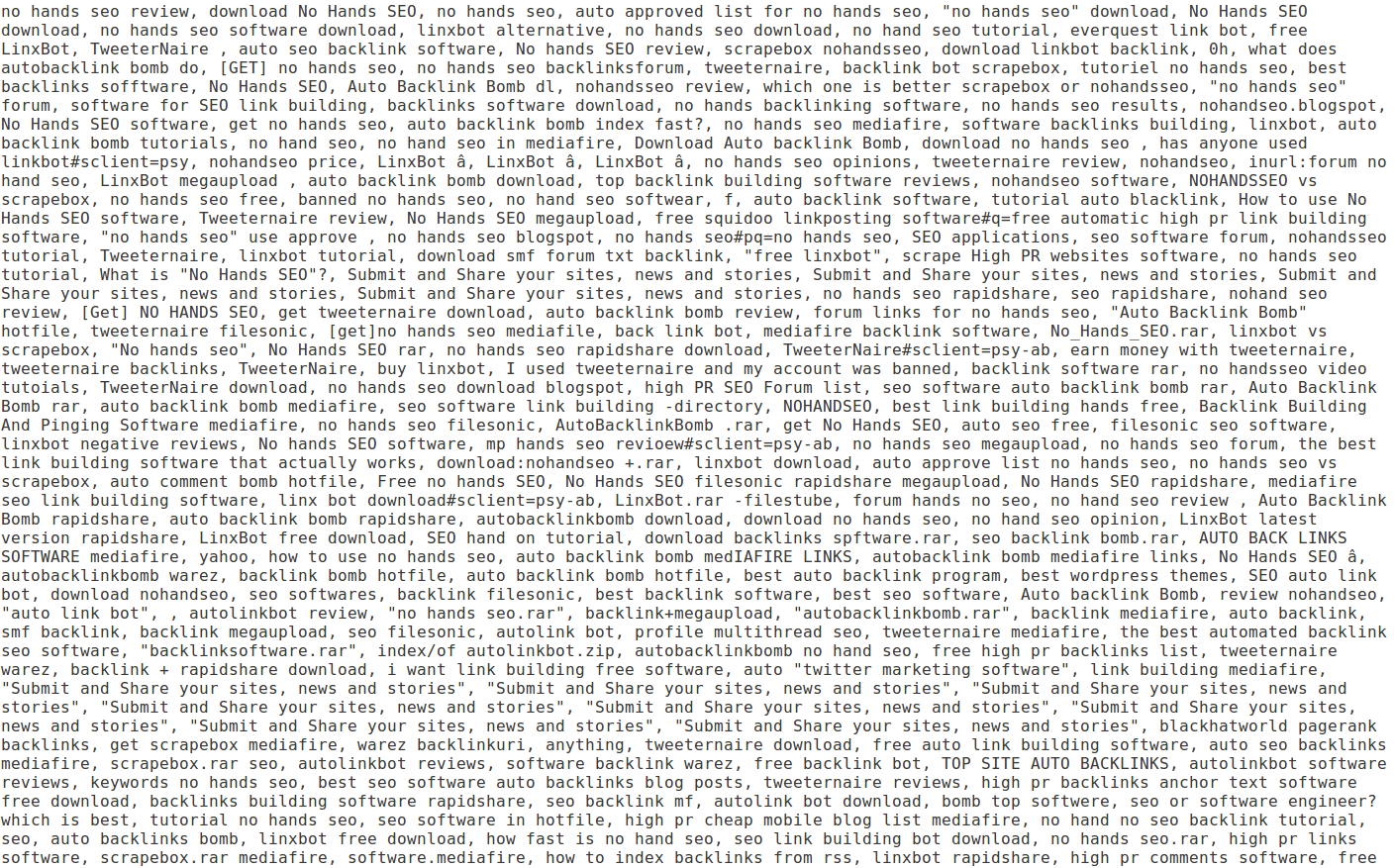

When Google rolled out the original version of Penguin on April 24, 2012 (primarily focused on link spam) they also rolled out an update to an on-page spam classifier for misdirection.

And, over time, it was quite common for Panda & Penguin updates to be sandwiched together.

If you were Google & had the ability to look under the hood to see why things changed, you would probably want to obfuscate any major update by changing multiple things at once to make reverse engineering the change much harder.

Anyone who operates a single website (& lacks the ability to look under the hood) will have almost no clue about what changed or how to adjust with the algorithms.

In the most recent algorithm update some sites which were penalized in prior “quality” updates have recovered.

Though many of those recoveries are only partial.

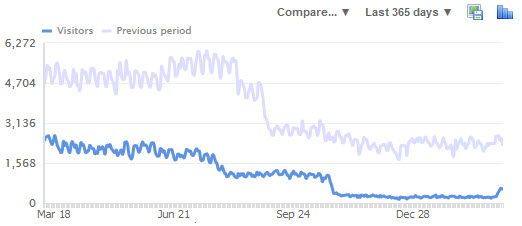

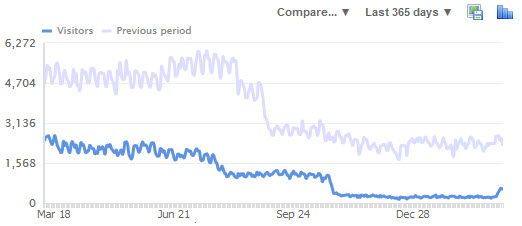

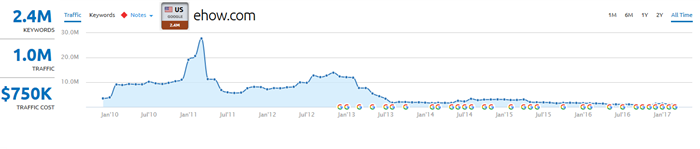

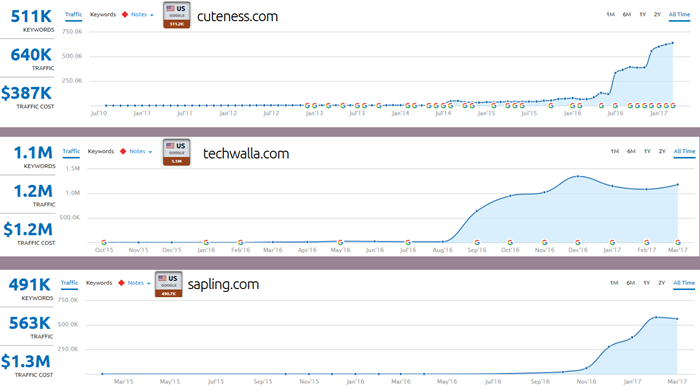

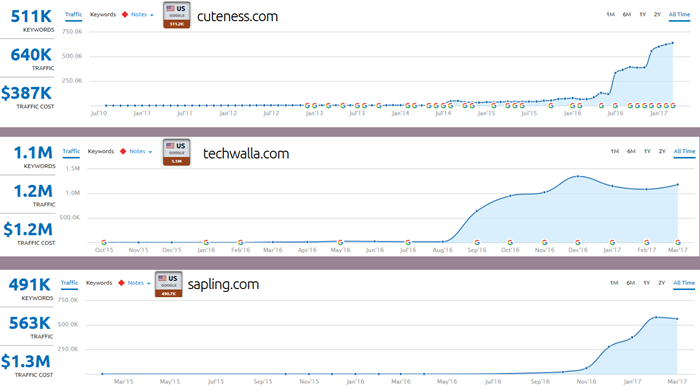

Many SEO blogs will publish articles about how they cracked the code on the latest update by publishing charts like the first one without publishing that second chart showing the broader context.

The first penalty any website receives might be the first of a series of penalties.

If Google smokes your site & it does not cause a PR incident & nobody really cares that you are gone, then there is a very good chance things will go from bad to worse to worser to worsterest, technically speaking.

“In this age, in this country, public sentiment is everything. With it, nothing can fail; against it, nothing can succeed. Whoever molds public sentiment goes deeper than he who enacts statutes, or pronounces judicial decisions.” – Abraham Lincoln

Absent effort & investment to evolve FASTER than the broader web, sites which are hit with one penalty will often further accumulate other penalties. It is like compound interest working in reverse – a pile of algorithmic debt which must be dug out of before the bleeding stops.

Further, many recoveries may be nothing more than a fleeting invitation to false hope. To pour more resources into a site that is struggling in an apparent death loop.

The above site which had its first positive algorithmic response in a couple years achieved that in part by heavily de-monetizing. After the algorithm updates already demonetized the website over 90%, what harm was there in removing 90% of what remained to see how it would react? So now it will get more traffic (at least for a while) but then what exactly is the traffic worth to a site that has no revenue engine tied to it?

That is ultimately the hard part. Obtaining a stable stream of traffic while monetizing at a decent yield, without the monetizing efforts leading to the traffic disappearing.

A buddy who owns the above site was working on link cleanup & content improvement on & off for about a half year with no results. Each month was a little worse than the prior month. It was only after I told him to remove the aggressive ads a few months back that he likely had any chance of seeing any sort of traffic recovery. Now he at least has a pulse of traffic & can look into lighter touch means of monetization.

If a site is consistently penalized then the problem might not be an algorithmic false positive, but rather the business model of the site.

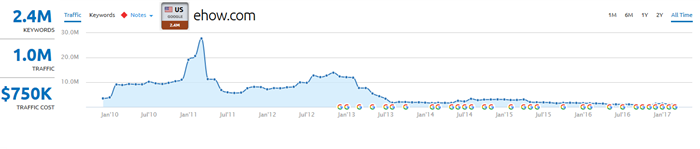

The more something looks like eHow the more fickle Google’s algorithmic with receive it.

Google does not like websites that sit at the end of the value chain & extract profits without having to bear far greater risk & expense earlier into the cycle.

Thin rewrites, largely speaking, don’t add value to the ecosystem. Doorway pages don’t either. And something that was propped up by a bunch of keyword-rich low-quality links is (in most cases) probably genuinely lacking in some other aspect.

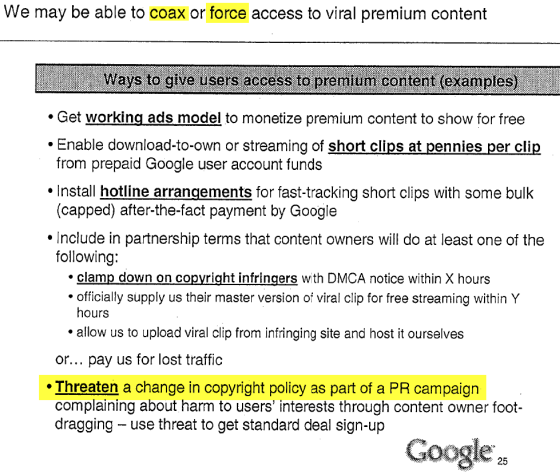

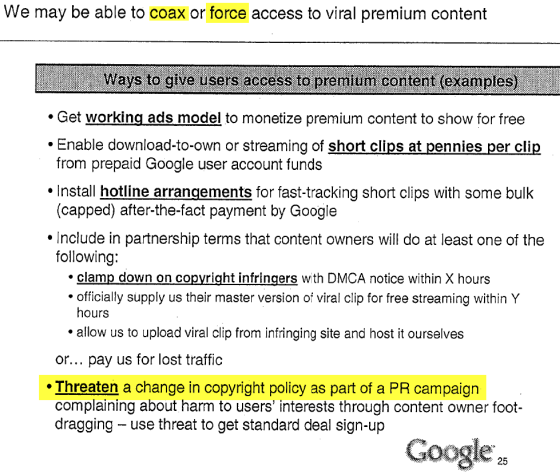

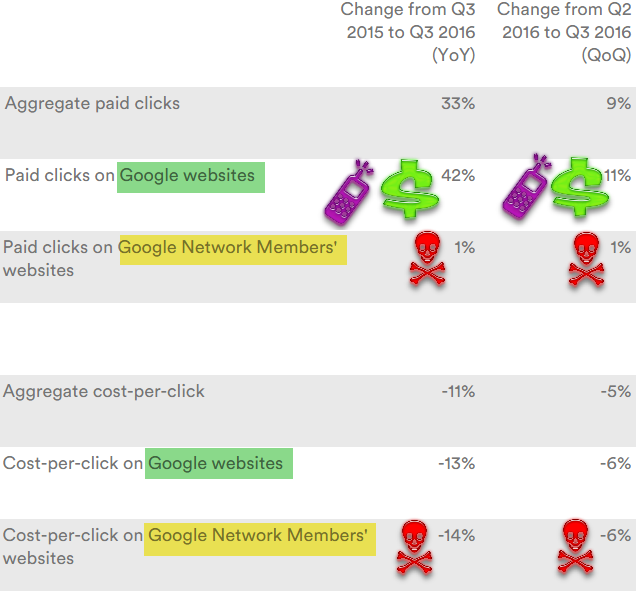

Generally speaking, Google would like themselves to be the entity at the end of the value chain extracting excess profits from markets.

RIP Quora!!! Q&A On Google – Showing Questions That Need Answers In Search https://t.co/mejXUDwGhT pic.twitter.com/8Cv1iKjDh2— John Shehata (@JShehata) March 18, 2019

This is the purpose of the knowledge graph & featured snippets. To allow the results to answer the most basic queries without third party publishers getting anything. The knowledge graph serve as a floating vertical that eat an increasing share of the value chain & force publishers to move higher up the funnel & publish more differentiated content.

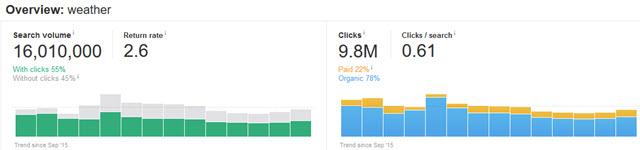

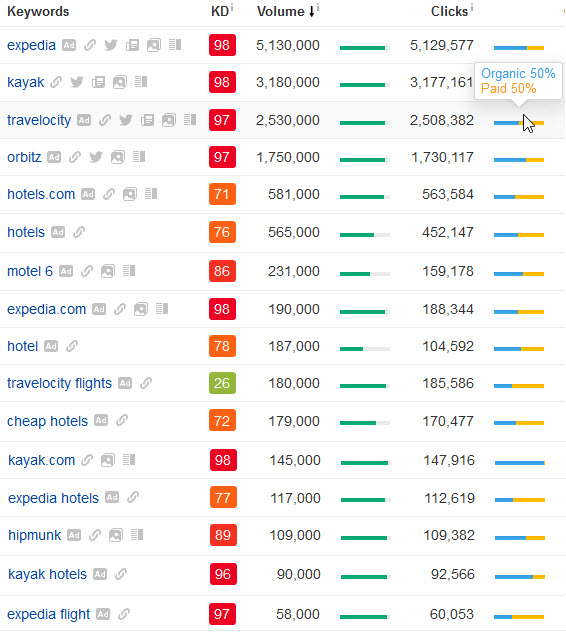

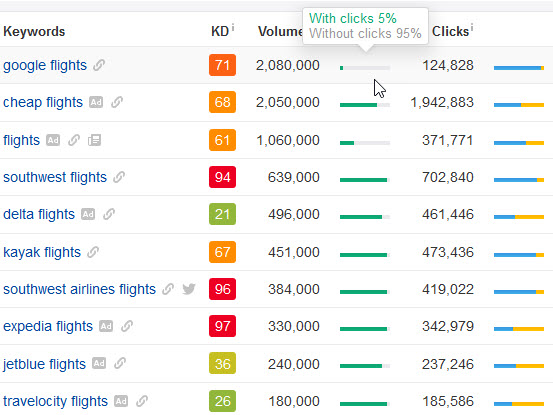

As Google adds features to the search results (flight price trends, a hotel booking service on the day AirBNB announced they acquired HotelTonight, ecommerce product purchase on Google, shoppable image ads just ahead of the Pinterest IPO, etc.) it forces other players in the value chain to consolidate (Expedia owns Orbitz, Travelocity, Hotwire & a bunch of other sites) or add greater value to remain a differentiated & sought after destination (travel review site TripAdvisor was crushed by the shift to mobile & the inability to monetize mobile traffic, so they eventually had to shift away from being exclusively a reviews site to offer event & hotel booking features to remain relevant).

It is never easy changing a successful & profitable business model, but it is even harder to intentionally reduce revenues further or spend aggressively to improve quality AFTER income has fallen 50% or more.

Some people do the opposite & make up for a revenue shortfall by publishing more lower end content at an ever faster rate and/or increasing ad load. Either of which typically makes their user engagement metrics worse while making their site less differentiated & more likely to receive additional bonus penalties to drive traffic even lower.

In some ways I think the ability for a site to survive & remain though a penalty is itself a quality signal for Google.

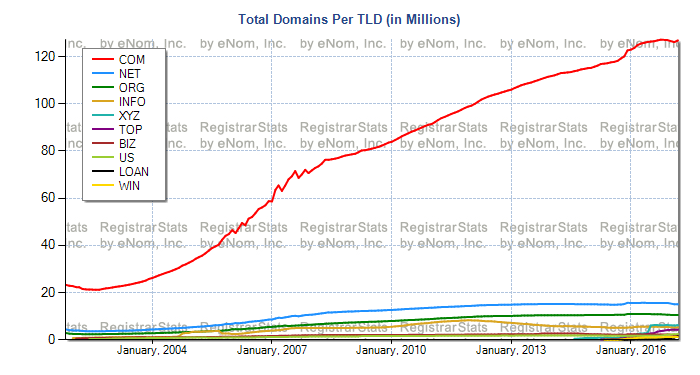

Some sites which are overly reliant on search & have no external sources of traffic are ultimately sites which tried to behave too similarly to the monopoly that ultimately displaced them. And over time the tech monopolies are growing more powerful as the ecosystem around them burns down:

If you had to choose a date for when the internet died, it would be in the year 2014. Before then, traffic to websites came from many sources, and the web was a lively ecosystem. But beginning in 2014, more than half of all traffic began coming from just two sources: Facebook and Google. Today, over 70 percent of traffic is dominated by those two platforms.

Businesses which have sustainable profit margins & slack (in terms of management time & resources to deploy) can better cope with algorithmic changes & change with the market.

Over the past half decade or so there have been multiple changes that drastically shifted the online publishing landscape:

- the shift to mobile, which both offers publishers lower ad yields while making the central ad networks more ad heavy in a way that reduces traffic to third party sites

- the rise of the knowledge graph & featured snippets which often mean publishers remain uncompensated for their work

- higher ad loads which also lower organic reach (on both search & social channels)

- the rise of programmatic advertising, which further gutted display ad CPMs

- the rise of ad blockers

- increasing algorithmic uncertainty & a higher barrier to entry

Each one of the above could take a double digit percent out of a site’s revenues, particularly if a site was reliant on display ads. Add them together and a website which was not even algorithmically penalized could still see a 60%+ decline in revenues. Mix in a penalty and that decline can chop a zero or two off the total revenues.

Businesses with lower margins can try to offset declines with increased ad spending, but that only works if you are not in a market with 2 & 20 VC fueled competition:

Startups spend almost 40 cents of every VC dollar on Google, Facebook, and Amazon. We don’t necessarily know which channels they will choose or the particularities of how they will spend money on user acquisition, but we do know more or less what’s going to happen. Advertising spend in tech has become an arms race: fresh tactics go stale in months, and customer acquisition costs keep rising. In a world where only one company thinks this way, or where one business is executing at a level above everyone else – like Facebook in its time – this tactic is extremely effective. However, when everyone is acting this way, the industry collectively becomes an accelerating treadmill. Ad impressions and click-throughs get bid up to outrageous prices by startups flush with venture money, and prospective users demand more and more subsidized products to gain their initial attention. The dynamics we’ve entered is, in many ways, creating a dangerous, high stakes Ponzi scheme.

And sometimes the platform claws back a second or third bite of the apple. Amazon.com charges merchants for fulfillment, warehousing, transaction based fees, etc. And they’ve pushed hard into launching hundreds of private label brands which pollute the interface & force brands to buy ads even on their own branded keyword terms.

They’ve recently jumped the shark by adding a bonus feature where even when a brand paid Amazon to send traffic to their listing, Amazon would insert a spam popover offering a cheaper private label branded product:

Amazon.com tested a pop-up feature on its app that in some instances pitched its private-label goods on rivals’ product pages, an experiment that shows the e-commerce giant’s aggressiveness in hawking lower-priced products including its own house brands. The recent experiment, conducted in Amazon’s mobile app, went a step further than the display ads that commonly appear within search results and product pages. This test pushed pop-up windows that took over much of a product page, forcing customers to either click through to the lower-cost Amazon products or dismiss them before continuing to shop. … When a customer using Amazon’s mobile app searched for “AAA batteries,” for example, the first link was a sponsored listing from Energizer Holdings Inc. After clicking on the listing, a pop-up window appeared, offering less expensive AmazonBasics AAA batteries.”

Buying those Amazon ads was quite literally subsidizing a direct competitor pushing you into irrelevance.

And while Amazon is destroying brand equity, AWS is doing investor relations matchmaking for startups. Anything to keep the current bubble going ahead of the Uber IPO that will likely mark the top in the stock market.

Some thoughts on Silicon Valley’s endgame. We have long said the biggest risk to the bull market is an Uber IPO. That is now upon us.— Jawad Mian (@jsmian) March 16, 2019

As the market caps of big tech companies climb they need to be more predatious to grow into the valuations & retain employees with stock options at an ever-increasing strike price.

They’ve created bubbles in their own backyards where each raise requires another. Teachers either drive hours to work or live in houses subsidized by loans from the tech monopolies that get a piece of the upside (provided they can keep their own bubbles inflated).

“It is an uncommon arrangement — employer as landlord — that is starting to catch on elsewhere as school employees say they cannot afford to live comfortably in regions awash in tech dollars. … Holly Gonzalez, 34, a kindergarten teacher in East San Jose, and her husband, Daniel, a school district I.T. specialist, were able to buy a three-bedroom apartment for $610,000 this summer with help from their parents and from Landed. When they sell the home, they will owe Landed 25 percent of any gain in its value. The company is financed partly by the Chan Zuckerberg Initiative, Mark Zuckerberg’s charitable arm.”

The above sort of dynamics have some claiming peak California:

The cycle further benefits from the Alchian-Allen effect: agglomerating industries have higher productivity, which raises the cost of living and prices out other industries, raising concentration over time. … Since startups raise the variance within whatever industry they’re started in, the natural constituency for them is someone who doesn’t have capital deployed in the industry. If you’re an asset owner, you want low volatility. … Historically, startups have created a constant supply of volatility for tech companies; the next generation is always cannibalizing the previous one. So chip companies in the 1970s created the PC companies of the 80s, but PC companies sourced cheaper and cheaper chips, commoditizing the product until Intel managed to fight back. Meanwhile, the OS turned PCs into a commodity, then search engines and social media turned the OS into a commodity, and presumably this process will continue indefinitely. … As long as higher rents raise the cost of starting a pre-revenue company, fewer people will join them, so more people will join established companies, where they’ll earn market salaries and continue to push up rents. And one of the things they’ll do there is optimize ad loads, which places another tax on startups. More dangerously, this is an incremental tax on growth rather than a fixed tax on headcount, so it puts pressure on out-year valuations, not just upfront cash flow.

If you live hundreds of miles away the tech companies may have no impact on your rental or purchase price, but you can’t really control the algorithms or the ecosystem.

All you can really control is your mindset & ensuring you have optionality baked into your business model.

- If you are debt-levered you have little to no optionality. Savings give you optionality. Savings allow you to run at a loss for a period of time while also investing in improving your site and perhaps having a few other sites in other markets.

- If you operate a single website that is heavily reliant on a third party for distribution then you have little to no optionality. If you have multiple projects that enables you to shift your attention toward working on whatever is going up and to the right while letting anything that is failing pass time without becoming overly reliant on something you can’t change. This is why it often makes sense for a brand merchant to operate their own ecommerce website even if 90% of their sales come from Amazon. It gives you optionality should the tech monopoly become abusive or otherwise harm you (even if the intent was benign rather than outright misanthropic).

As the update ensues Google will collect more data with how users interact with the result set & determine how to weight different signals, along with re-scoring sites that recovered based on the new engagement data.

Recently a Bing engineer named Frédéric Dubut described how they score relevancy signals used in updates

As early as 2005, we used neural networks to power our search engine and you can still find rare pictures of Satya Nadella, VP of Search and Advertising at the time, showcasing our web ranking advances. … The “training” process of a machine learning model is generally iterative (and all automated). At each step, the model is tweaking the weight of each feature in the direction where it expects to decrease the error the most. After each step, the algorithm remeasures the rating of all the SERPs (based on the known URL/query pair ratings) to evaluate how it’s doing. Rinse and repeat.

That same process is ongoing with Google now & in the coming weeks there’ll be the next phase of the current update.

So far it looks like some quality-based re-scoring was done & some sites which were overly reliant on anchor text got clipped. On the back end of the update there’ll be another quality-based re-scoring, but the sites that were hit for excessive manipulation of anchor text via link building efforts will likely remain penalized for a good chunk of time.

Update: It appears a major reverberation of this update occurred on April 7th. From early analysis, Google is mixing in showing results for related midtail concepts on a core industry search term & they are also in some cases pushing more aggressively on doing internal site-level searches to rank a more relevant internal page for a query where they homepage might have ranked in the past.

Google Florida 2.0 Algorithm Update: Early Observations

It has been a while since Google has had a major algorithm update.

They recently announced one which began on the 12th of March.

This week, we released a broad core algorithm update, as we do several times per year. Our guidance about such updates remains as we’ve covered before. Please see these tweets for more about that:https://t.co/uPlEdSLHoXhttps://t.co/tmfQkhdjPL— Google SearchLiaison (@searchliaison) March 13, 2019

What changed?

It appears multiple things did.

When Google rolled out the original version of Penguin on April 24, 2012 (primarily focused on link spam) they also rolled out an update to an on-page spam classifier for misdirection.

And, over time, it was quite common for Panda & Penguin updates to be sandwiched together.

If you were Google & had the ability to look under the hood to see why things changed, you would probably want to obfuscate any major update by changing multiple things at once to make reverse engineering the change much harder.

Anyone who operates a single website (& lacks the ability to look under the hood) will have almost no clue about what changed or how to adjust with the algorithms.

In the most recent algorithm update some sites which were penalized in prior “quality” updates have recovered.

Though many of those recoveries are only partial.

Many SEO blogs will publish articles about how they cracked the code on the latest update by publishing charts like the first one without publishing that second chart showing the broader context.

The first penalty any website receives might be the first of a series of penalties.

If Google smokes your site & it does not cause a PR incident & nobody really cares that you are gone, then there is a very good chance things will go from bad to worse to worser to worsterest, technically speaking.

“In this age, in this country, public sentiment is everything. With it, nothing can fail; against it, nothing can succeed. Whoever molds public sentiment goes deeper than he who enacts statutes, or pronounces judicial decisions.” – Abraham Lincoln

Absent effort & investment to evolve FASTER than the broader web, sites which are hit with one penalty will often further accumulate other penalties. It is like compound interest working in reverse – a pile of algorithmic debt which must be dug out of before the bleeding stops.

Further, many recoveries may be nothing more than a fleeting invitation to false hope. To pour more resources into a site that is struggling in an apparent death loop.

The above site which had its first positive algorithmic response in a couple years achieved that in part by heavily de-monetizing. After the algorithm updates already demonetized the website over 90%, what harm was there in removing 90% of what remained to see how it would react? So now it will get more traffic (at least for a while) but then what exactly is the traffic worth to a site that has no revenue engine tied to it?

That is ultimately the hard part. Obtaining a stable stream of traffic while monetizing at a decent yield, without the monetizing efforts leading to the traffic disappearing.

A buddy who owns the above site was working on link cleanup & content improvement on & off for about a half year with no results. Each month was a little worse than the prior month. It was only after I told him to remove the aggressive ads a few months back that he likely had any chance of seeing any sort of traffic recovery. Now he at least has a pulse of traffic & can look into lighter touch means of monetization.

If a site is consistently penalized then the problem might not be an algorithmic false positive, but rather the business model of the site.

The more something looks like eHow the more fickle Google’s algorithmic with receive it.

Google does not like websites that sit at the end of the value chain & extract profits without having to bear far greater risk & expense earlier into the cycle.

Thin rewrites, largely speaking, don’t add value to the ecosystem. Doorway pages don’t either. And something that was propped up by a bunch of keyword-rich low-quality links is (in most cases) probably genuinely lacking in some other aspect.

Generally speaking, Google would like themselves to be the entity at the end of the value chain extracting excess profits from markets.

This is the purpose of the knowledge graph & featured snippets. To allow the results to answer the most basic queries without third party publishers getting anything. The knowledge graph serve as a floating vertical that eat an increasing share of the value chain & force publishers to move higher up the funnel & publish more differentiated content.

As Google adds features to the search results (flight price trends, a hotel booking service on the day AirBNB announced they acquired HotelTonight, ecommerce product purchase on Google, shoppable image ads just ahead of the Pinterest IPO, etc.) it forces other players in the value chain to consolidate (Expedia owns Orbitz, Travelocity, Hotwire & a bunch of other sites) or add greater value to remain a differentiated & sought after destination (travel review site TripAdvisor was crushed by the shift to mobile & the inability to monetize mobile traffic, so they eventually had to shift away from being exclusively a reviews site to offer event & hotel booking features to remain relevant).

It is never easy changing a successful & profitable business model, but it is even harder to intentionally reduce revenues further or spend aggressively to improve quality AFTER income has fallen 50% or more.

Some people do the opposite & make up for a revenue shortfall by publishing more lower end content at an ever faster rate and/or increasing ad load. Either of which typically makes their user engagement metrics worse while making their site less differentiated & more likely to receive additional bonus penalties to drive traffic even lower.

In some ways I think the ability for a site to survive & remain though a penalty is itself a quality signal for Google.

Some sites which are overly reliant on search & have no external sources of traffic are ultimately sites which tried to behave too similarly to the monopoly that ultimately displaced them. And over time the tech monopolies are growing more powerful as the ecosystem around them burns down:

If you had to choose a date for when the internet died, it would be in the year 2014. Before then, traffic to websites came from many sources, and the web was a lively ecosystem. But beginning in 2014, more than half of all traffic began coming from just two sources: Facebook and Google. Today, over 70 percent of traffic is dominated by those two platforms.

Businesses which have sustainable profit margins & slack (in terms of management time & resources to deploy) can better cope with algorithmic changes & change with the market.

Over the past half decade or so there have been multiple changes that drastically shifted the online publishing landscape:

- the shift to mobile, which both offers publishers lower ad yields while making the central ad networks more ad heavy in a way that reduces traffic to third party sites

- the rise of the knowledge graph & featured snippets which often mean publishers remain uncompensated for their work

- higher ad loads which also lower organic reach (on both search & social channels)

- the rise of programmatic advertising, which further gutted display ad CPMs

- the rise of ad blockers

- increasing algorithmic uncertainty & a higher barrier to entry

Each one of the above could take a double digit percent out of a site’s revenues, particularly if a site was reliant on display ads. Add them together and a website which was not even algorithmically penalized could still see a 60%+ decline in revenues. Mix in a penalty and that decline can chop a zero or two off the total revenues.

Businesses with lower margins can try to offset declines with increased ad spending, but that only works if you are not in a market with 2 & 20 VC fueled competition:

Startups spend almost 40 cents of every VC dollar on Google, Facebook, and Amazon. We don’t necessarily know which channels they will choose or the particularities of how they will spend money on user acquisition, but we do know more or less what’s going to happen. Advertising spend in tech has become an arms race: fresh tactics go stale in months, and customer acquisition costs keep rising. In a world where only one company thinks this way, or where one business is executing at a level above everyone else – like Facebook in its time – this tactic is extremely effective. However, when everyone is acting this way, the industry collectively becomes an accelerating treadmill. Ad impressions and click-throughs get bid up to outrageous prices by startups flush with venture money, and prospective users demand more and more subsidized products to gain their initial attention. The dynamics we’ve entered is, in many ways, creating a dangerous, high stakes Ponzi scheme.

And sometimes the platform claws back a second or third bite of the apple. Amazon.com charges merchants for fulfillment, warehousing, transaction based fees, etc. And they’ve pushed hard into launching hundreds of private label brands which pollute the interface & force brands to buy ads even on their own branded keyword terms.

They’ve recently jumped the shark by adding a bonus feature where even when a brand paid Amazon to send traffic to their listing, Amazon would insert a spam popover offering a cheaper private label branded product:

Amazon.com tested a pop-up feature on its app that in some instances pitched its private-label goods on rivals’ product pages, an experiment that shows the e-commerce giant’s aggressiveness in hawking lower-priced products including its own house brands. The recent experiment, conducted in Amazon’s mobile app, went a step further than the display ads that commonly appear within search results and product pages. This test pushed pop-up windows that took over much of a product page, forcing customers to either click through to the lower-cost Amazon products or dismiss them before continuing to shop. … When a customer using Amazon’s mobile app searched for “AAA batteries,” for example, the first link was a sponsored listing from Energizer Holdings Inc. After clicking on the listing, a pop-up window appeared, offering less expensive AmazonBasics AAA batteries.”

Buying those Amazon ads was quite literally subsidizing a direct competitor pushing you into irrelevance.

And while Amazon is destroying brand equity, AWS is doing investor relations matchmaking for startups. Anything to keep the current bubble going ahead of the Uber IPO that will likely mark the top in the stock market.

Some thoughts on Silicon Valley’s endgame. We have long said the biggest risk to the bull market is an Uber IPO. That is now upon us.— Jawad Mian (@jsmian) March 16, 2019

As the market caps of big tech companies climb they need to be more predatious to grow into the valuations & retain employees with stock options at an ever-increasing strike price.

They’ve created bubbles in their own backyards where each raise requires another. Teachers either drive hours to work or live in houses subsidized by loans from the tech monopolies that get a piece of the upside (provided they can keep their own bubbles inflated).

“It is an uncommon arrangement — employer as landlord — that is starting to catch on elsewhere as school employees say they cannot afford to live comfortably in regions awash in tech dollars. … Holly Gonzalez, 34, a kindergarten teacher in East San Jose, and her husband, Daniel, a school district I.T. specialist, were able to buy a three-bedroom apartment for $610,000 this summer with help from their parents and from Landed. When they sell the home, they will owe Landed 25 percent of any gain in its value. The company is financed partly by the Chan Zuckerberg Initiative, Mark Zuckerberg’s charitable arm.”

The above sort of dynamics have some claiming peak California:

The cycle further benefits from the Alchian-Allen effect: agglomerating industries have higher productivity, which raises the cost of living and prices out other industries, raising concentration over time. … Since startups raise the variance within whatever industry they’re started in, the natural constituency for them is someone who doesn’t have capital deployed in the industry. If you’re an asset owner, you want low volatility. … Historically, startups have created a constant supply of volatility for tech companies; the next generation is always cannibalizing the previous one. So chip companies in the 1970s created the PC companies of the 80s, but PC companies sourced cheaper and cheaper chips, commoditizing the product until Intel managed to fight back. Meanwhile, the OS turned PCs into a commodity, then search engines and social media turned the OS into a commodity, and presumably this process will continue indefinitely. … As long as higher rents raise the cost of starting a pre-revenue company, fewer people will join them, so more people will join established companies, where they’ll earn market salaries and continue to push up rents. And one of the things they’ll do there is optimize ad loads, which places another tax on startups. More dangerously, this is an incremental tax on growth rather than a fixed tax on headcount, so it puts pressure on out-year valuations, not just upfront cash flow.

If you live hundreds of miles away the tech companies may have no impact on your rental or purchase price, but you can’t really control the algorithms or the ecosystem.

All you can really control is your mindset & ensuring you have optionality baked into your business model.

- If you are debt-levered you have little to no optionality. Savings give you optionality. Savings allow you to run at a loss for a period of time while also investing in improving your site and perhaps having a few other sites in other markets.

- If you operate a single website that is heavily reliant on a third party for distribution then you have little to no optionality. If you have multiple projects that enables you to shift your attention toward working on whatever is going up and to the right while letting anything that is failing pass time without becoming overly reliant on something you can’t change. This is why it often makes sense for a brand merchant to operate their own ecommerce website even if 90% of their sales come from Amazon. It gives you optionality should the tech monopoly become abusive or otherwise harm you (even if the intent was rather than outright misanthropic).

As the update ensues Google will collect more data with how users interact with the result set & determine how to weight different signals, along with re-scoring sites that recovered based on the new engagement data.

Recently a Bing engineer named Frédéric Dubut described how they score relevancy signals used in updates

As early as 2005, we used neural networks to power our search engine and you can still find rare pictures of Satya Nadella, VP of Search and Advertising at the time, showcasing our web ranking advances. … The “training” process of a machine learning model is generally iterative (and all automated). At each step, the model is tweaking the weight of each feature in the direction where it expects to decrease the error the most. After each step, the algorithm remeasures the rating of all the SERPs (based on the known URL/query pair ratings) to evaluate how it’s doing. Rinse and repeat.

That same process is ongoing with Google now & in the coming weeks there’ll be the next phase of the current update.

So far it looks like some quality-based re-scoring was done & some sites which were overly reliant on anchor text got clipped. On the back end of the update there’ll be another quality-based re-scoring, but the sites that were hit for excessive manipulation of anchor text via link building efforts will likely remain penalized for a good chunk of time.

A Darker Shade of Gray

Google’s original breakthrough in search was placing weight on links & using them to approximate the behavior of web users.

The abstract of

The PageRank Citation Ranking: Bringing Order to the Web reads

The importance of a Web page is an inherently subjective matter, which depends on the readers interests, knowledge and attitudes. But there is still much that can be said objectively about the relative importance of Web pages. This paper describes PageRank, a method for rating Web pages objectively and mechanically, effectively measuring the human interest and attention devoted to them. We compare PageRank to an idealized random Web surfer. We show how to efficiently compute PageRank for large numbers of pages. And, we show how to apply PageRank to search and to user navigation.

Back when I got started in the search game if you wanted to rank better you simply threw more links at whatever you wanted to rank & used the anchor text you wanted to rank for. A friend (who will remain nameless here!) used to rank websites for one-word search queries in major industries without even looking at them. :D

Suffice it to say, as more people read about PageRank & learned the influence of anchor text, Google had to advance their algorithms in order to counteract efforts to manipulate them.

Over the years as Google has grown more dominant they have been able to create many other signals. Some signals might be easy to understand & explain, while signals that approximate abstract concepts (like brand) might be a bit more convoluted to understand or attempt to explain.

Google owns the most widely used web browser (Chrome) & the most popular mobile operating system (Android). Owning those gives Google unique insights to where they do not need to place as much weight on a links-driven approximation of a random web user. They can see what users actually do & model their algorithms based on that.

Google considers the user experience an important part of their ranking algorithms. That was a big part of the heavy push for making mobile responsive web designs.

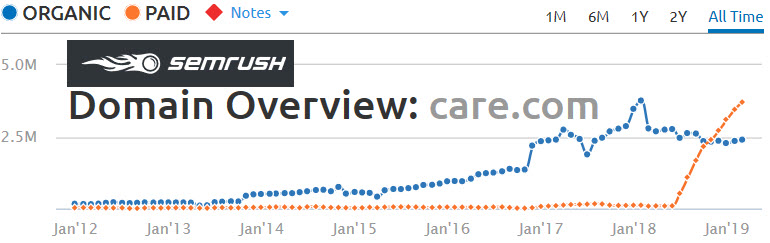

On your money or your life topics Google considers the experience so important they have an acronym covering the categories (YMYL) and place greater emphasis on the reliability of the user experience.

Nobody wants to die from a junk piece of medical advice or a matching service which invites predators into their homes.

The Wall Street Journal publishes original reporting which is so influential they almost act as the missing regulator in many instances.

Last Friday the WSJ covered the business practices of Care.com, a company which counts Alphabet’s Capital G as its biggest shareholder.

Behind Care.com’s appeal is a pledge to “help families make informed hiring decisions” about caregivers, as it has said on its website. Still, Care.com largely leaves it to families to figure out whether the caregivers it lists are trustworthy. … In about 9 instances over the past six years, caregivers in the U.S. who had police records were listed on Care.com and later were accused of committing crimes while caring for customers’ children or elderly relatives … Alleged crimes included theft, child abuse, sexual assault and murder. The Journal also found hundreds of instances in which day-care centers listed on Care.com as state-licensed didn’t appear to be. … Care.com states on listings that it doesn’t verify licenses, in small gray type at the bottom … A spokeswoman said that Care.com, like other companies, adds listings found in “publicly available data,” and that most day-care centers on its site didn’t pay for their listings. She said in the next few years Care.com will begin a program in which it vets day-care centers.

By Monday Care.com’s stock was sliding, which led to prompt corrective actions:

Previously the company warned users in small grey type at the bottom of a day-care center listing that it didn’t verify credentials or licensing information. Care.com said Monday it “has made more prominent” that notice.

To this day, Care.com’s homepage states…

“Care.com does not employ any care provider or care seeker nor is it responsible for the conduct of any care provider or care seeker. … The information contained in member profiles, job posts and applications are supplied by care providers and care seekers themselves and is not information generated or verified by Care.com.”

…in an ever so slightly darker shade of gray.

So far it appears to have worked for them.

What’s your favorite color?

A Darker Shade of Gray

Google’s original breakthrough in search was placing weight on links & using them to approximate the behavior of web users.

The abstract of

The PageRank Citation Ranking: Bringing Order to the Web reads

The importance of a Web page is an inherently subjective matter, which depends on the readers interests, knowledge and attitudes. But there is still much that can be said objectively about the relative importance of Web pages. This paper describes PageRank, a method for rating Web pages objectively and mechanically, effectively measuring the human interest and attention devoted to them. We compare PageRank to an idealized random Web surfer. We show how to efficiently compute PageRank for large numbers of pages. And, we show how to apply PageRank to search and to user navigation.

Back when I got started in the search game if you wanted to rank better you simply threw more links at whatever you wanted to rank & used the anchor text you wanted to rank for. A friend (who will remain nameless here!) used to rank websites for one-word search queries in major industries without even looking at them. :D

Suffice it to say, as more people read about PageRank & learned the influence of anchor text, Google had to advance their algorithms in order to counteract efforts to manipulate them.

Over the years as Google has grown more dominant they have been able to create many other signals. Some signals might be easy to understand & explain, while signals that approximate abstract concepts (like brand) might be a bit more convoluted to understand or attempt to explain.

Google owns the most widely used web browser (Chrome) & the most popular mobile operating system (Android). Owning those gives Google unique insights to where they do not need to place as much weight on a links-driven approximation of a random web user. They can see what users actually do & model their algorithms based on that.

Google considers the user experience an important part of their ranking algorithms. That was a big part of the heavy push for making mobile responsive web designs.

On your money or your life topics Google considers the experience so important they have an acronym covering the categories (YMYL) and place greater emphasis on the reliability of the user experience.

Nobody wants to die from a junk piece of medical advice or a matching service which invites predators into their homes.

The Wall Street Journal publishes original reporting which is so influential they almost act as the missing regulator in many instances.

Last Friday the WSJ covered the business practices of Care.com, a company which counts Alphabet’s Capital G as its biggest shareholder.

Behind Care.com’s appeal is a pledge to “help families make informed hiring decisions” about caregivers, as it has said on its website. Still, Care.com largely leaves it to families to figure out whether the caregivers it lists are trustworthy. … In about 9 instances over the past six years, caregivers in the U.S. who had police records were listed on Care.com and later were accused of committing crimes while caring for customers’ children or elderly relatives … Alleged crimes included theft, child abuse, sexual assault and murder. The Journal also found hundreds of instances in which day-care centers listed on Care.com as state-licensed didn’t appear to be. … Care.com states on listings that it doesn’t verify licenses, in small gray type at the bottom … A spokeswoman said that Care.com, like other companies, adds listings found in “publicly available data,” and that most day-care centers on its site didn’t pay for their listings. She said in the next few years Care.com will begin a program in which it vets day-care centers.

By Monday Care.com’s stock was sliding, which led to prompt corrective actions:

Previously the company warned users in small grey type at the bottom of a day-care center listing that it didn’t verify credentials or licensing information. Care.com said Monday it “has made more prominent” that notice.

To this day, Care.com’s homepage states…

“Care.com does not employ any care provider or care seeker nor is it responsible for the conduct of any care provider or care seeker. … The information contained in member profiles, job posts and applications are supplied by care providers and care seekers themselves and is not information generated or verified by Care.com.”

…in an ever so slightly darker shade of gray.

So far it appears to have worked for them.

What’s your favorite color?

Left is Right & Up is Down

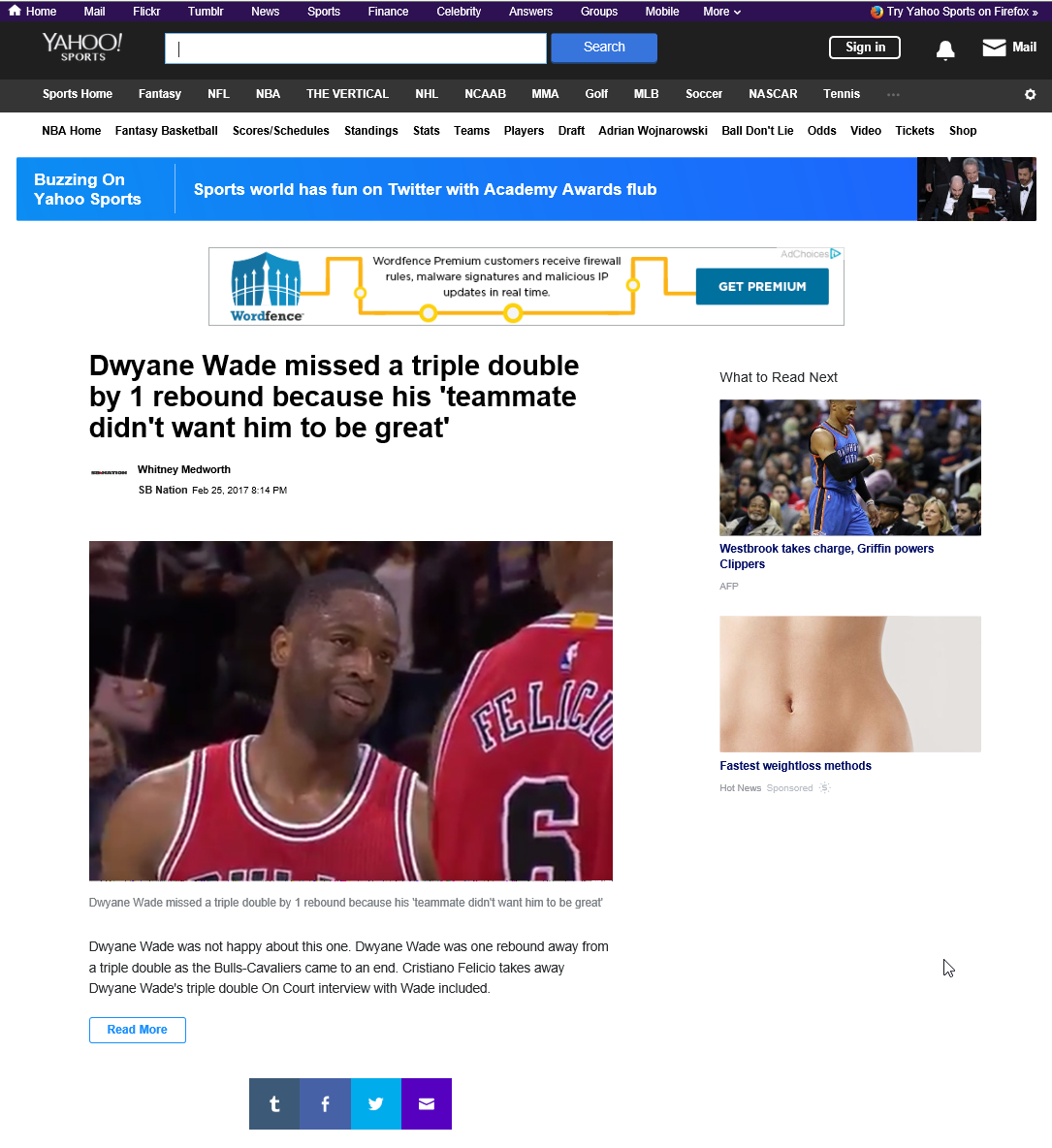

Probably the single best video to watch to understand the power of Google & Facebook (or even most of the major problems across society) is this following video about pleasure versus happiness.

In constantly seeking pleasure we forego happiness.

The “feed” based central aggregation networks are just like slot machines in your pocket: variable reward circuitry which self-optimizes around exploiting your flaws to eat as much attention as possible.

The above is not an accident. It is, rather, as intended:

“That means that we needed to sort of give you a little dopamine hit every once in a while because someone liked or commented on a photo or a post or whatever … It’s a social validation feedback loop … You’re exploiting a vulnerability in human psychology … [The inventors] understood this, consciously, and we did it anyway.”

- Happy? Good! Share posed photos to make your friends feel their lives are worse than your life is.

- Outraged? Good! Click an ad.

- Hopeless? Good. There is a product which can deliver you pleasure…if only you can…click an ad.

Using machine learning to drive rankings is ultimately an exercise in confirmation bias:

For “Should abortion be legal?” Google cited a South African news site saying, “It is not the place of government to legislate against woman’s choices.”

When asked, “Should abortion be illegal?” it promoted an answer from obscure clickbait site listland.com stating, “Abortion is murder.”

Excellent work Google in using your featured snippets to help make the world more absolutist, polarized & toxic.

The central network operators not only attempt to manipulate people at the emotional level, but the layout of the interface also sets default user patterns.

Most users tend to focus their attention on the left side of the page: “if we were to slice a maximized page down the middle, 80% of the fixations fell on the left half of the screen (even more than our previous finding of 69%). The remaining 20% of fixations were on the right half of the screen.”

This behavior is even more prevalent on search results pages: “On SERPs, almost all fixations (94%) fell on the left side of the page, and 60% those fixations can be isolated to the leftmost 400px.”

On mobile, obviously, the attention is focused on what is above the fold. That which is below the fold sort of doesn’t even exist for a large subset of the population.

Outside of a few central monopoly attention merchant players, the ad-based web is dying.

Mashable has raised about $46 million in VC funding over the past 4 years. And they just sold for about $50 million.

Breaking even is about as good as it gets in a web controlled by the Google / Facebook duopoly. :D

Other hopeful unicorn media startups appear to have peaked as well. That BuzzFeed IPO is on hold: “Some BuzzFeed investors have become worried about the company’s performance and rising costs for expansions in areas like news and entertainment. Those frustrations were aired at a board meeting in recent weeks, in which directors took management to task, the people familiar with the situation said.”

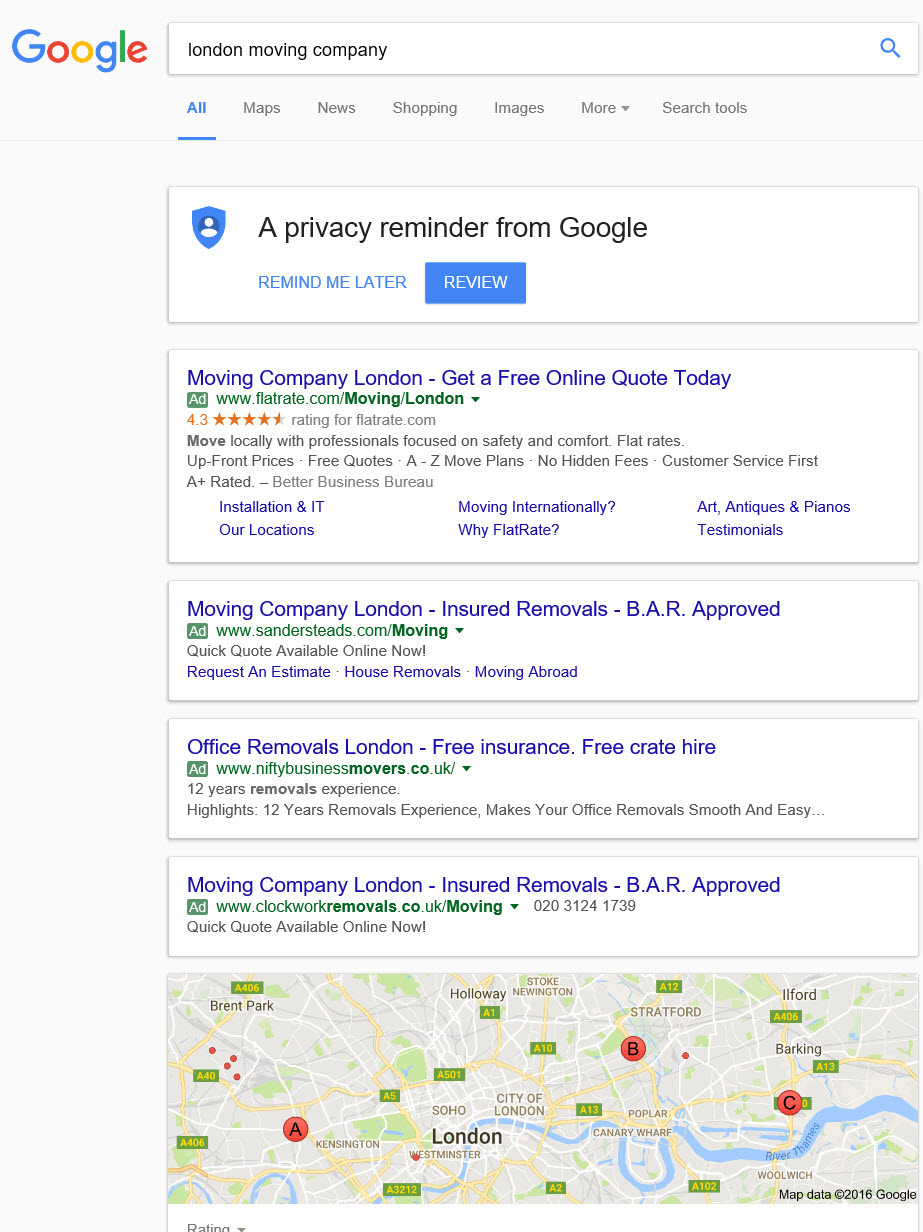

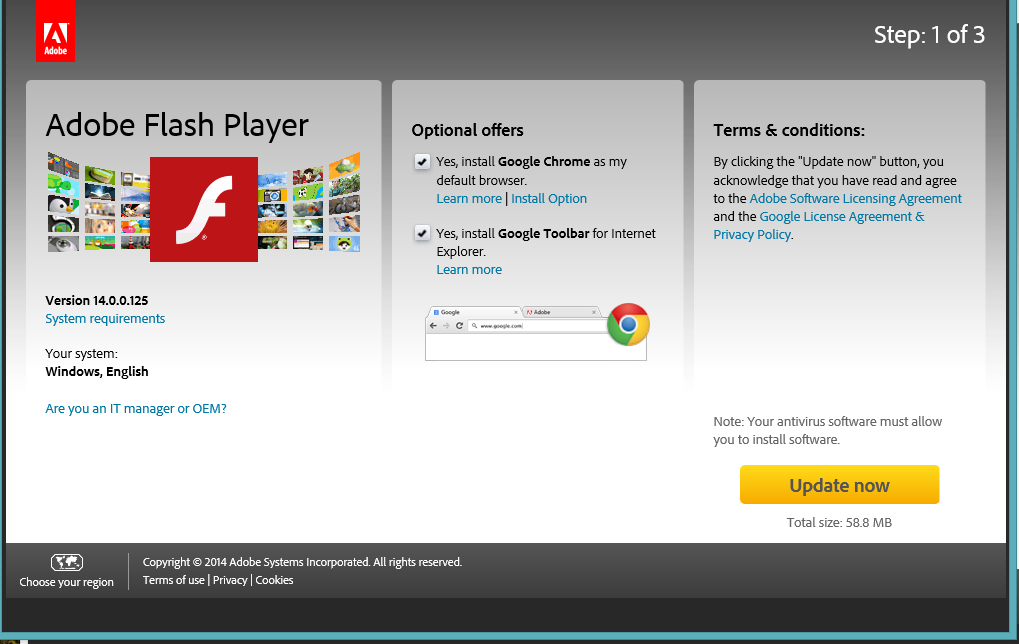

Google’s Chrome web browser will soon have an ad blocker baked into it. Of course the central networks opt out of applying this feature to themselves. Facebook makes serious coin by blocking ad blockers. Google pays Adblock Plus to unblock ads on Google.com & boy are there a lot of ads there.

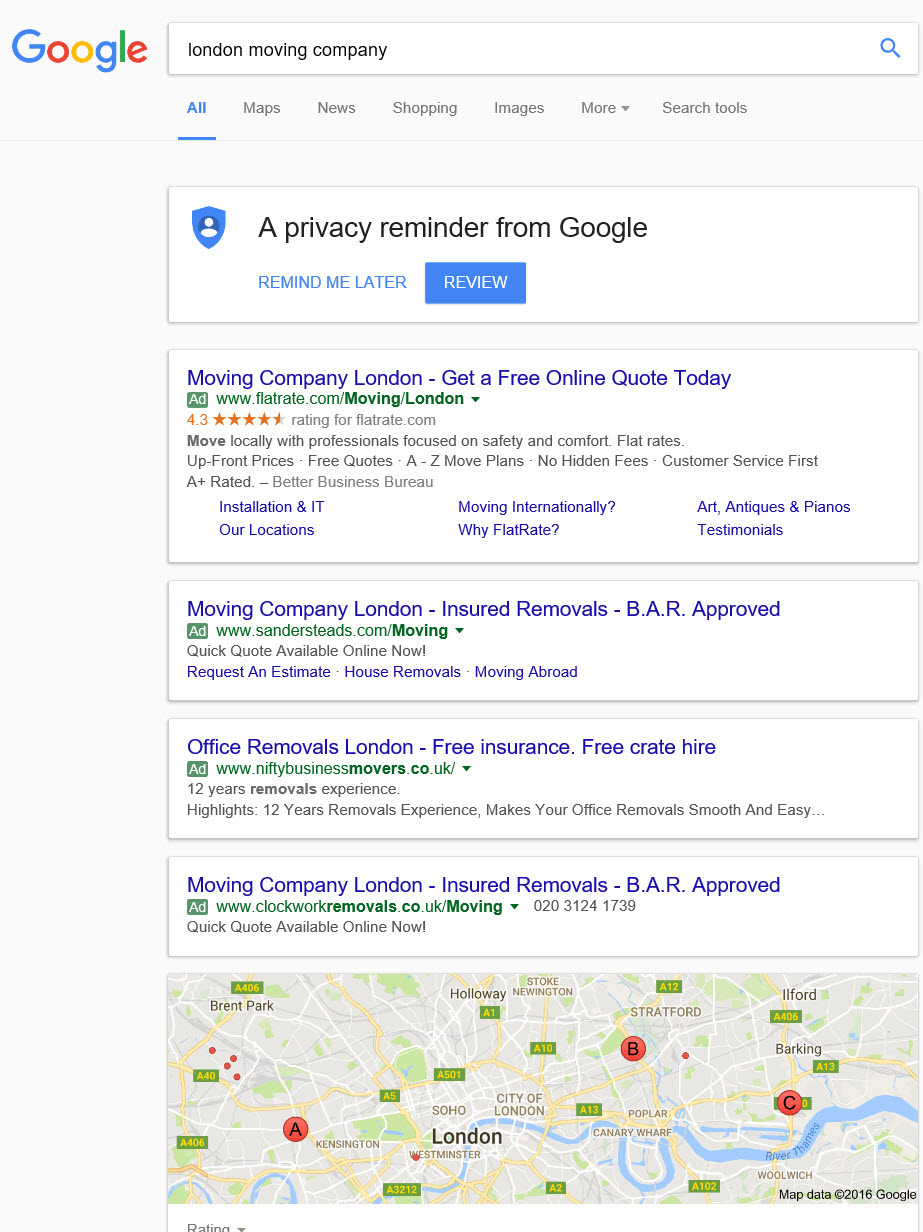

Format your pages like Google does their search results and they will tell you it is a piss poor user experience & a form of spam – whacking you with a penalty for it.

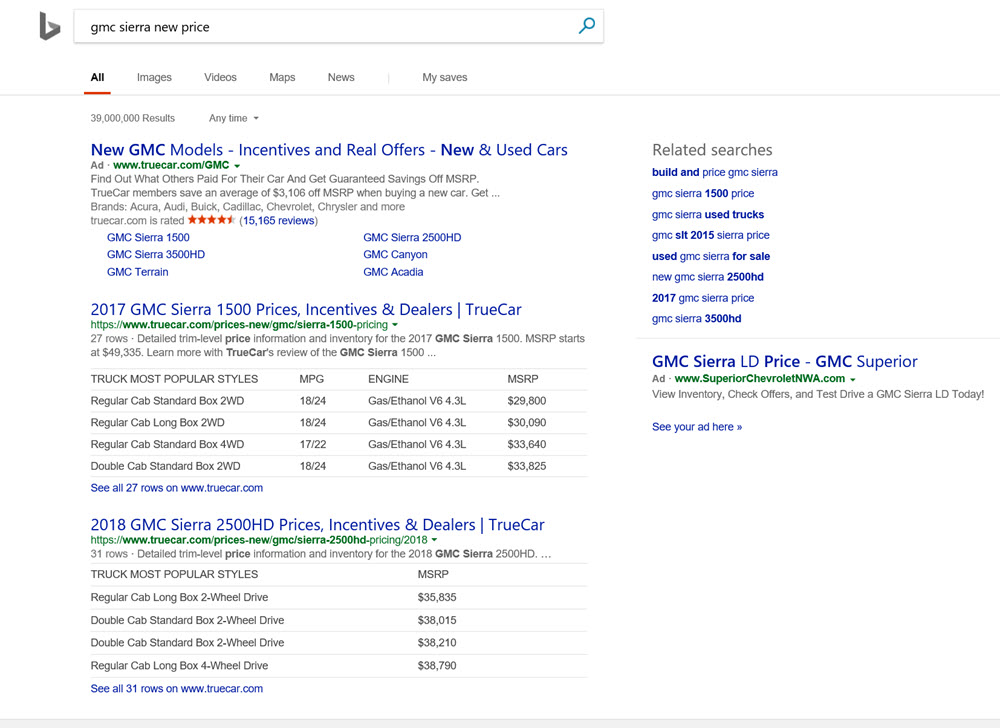

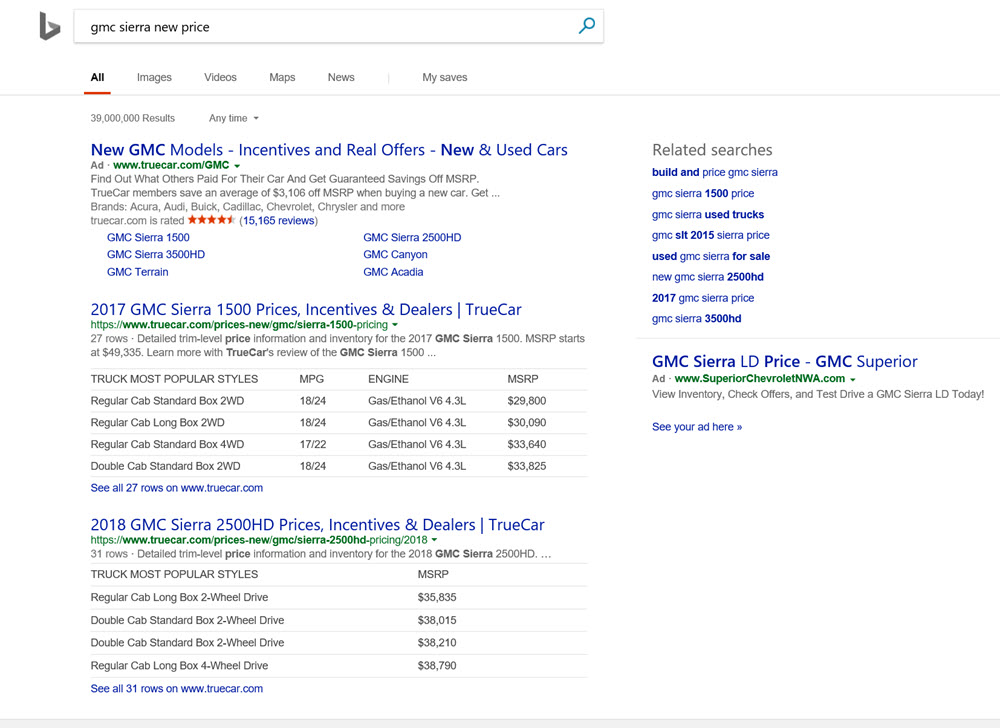

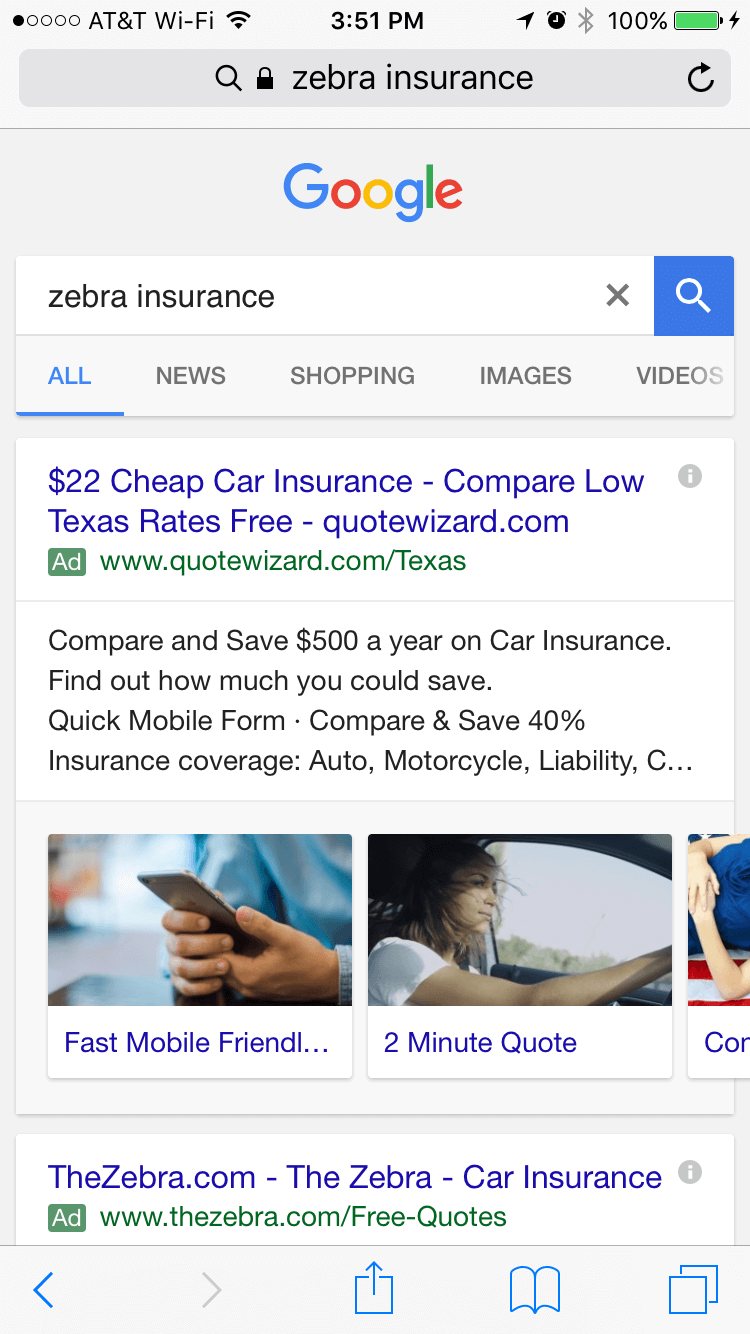

Of course Google isn’t the only search engine doing this. Mix in ads with a double listing and sometimes there will only be 1 website listed above the fold.

I’ve even seen some Bing search results where organic results have a “Web” label on them – which is conveniently larger than the ad label that is on ads. That is in addition to other tricks like…

lots of ad extensions that push organics below the fold on anything with the slightest commercial intent

bolding throughout ads (title, description, URL) with much lighter bolding of organics

only showing 6 organic results on commercial searches that are likely to generate ad clicks

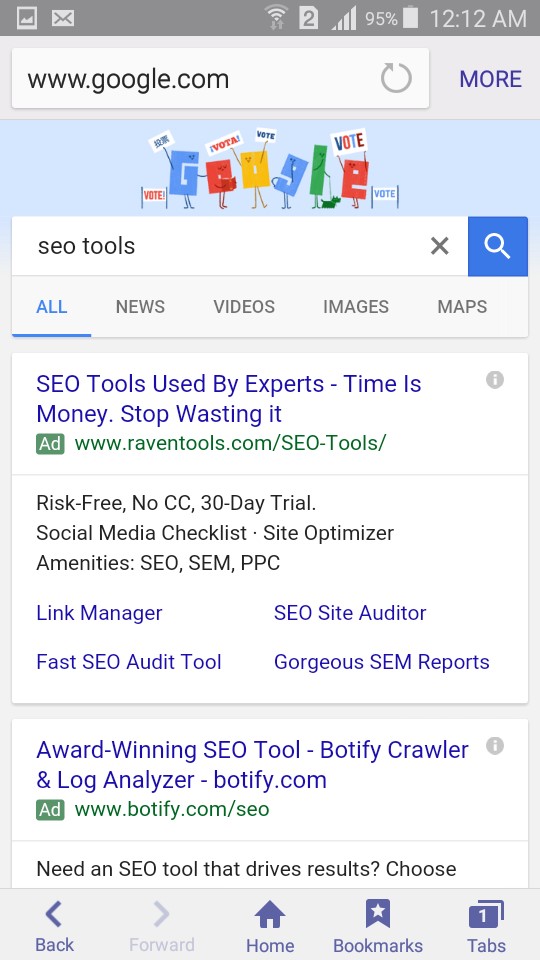

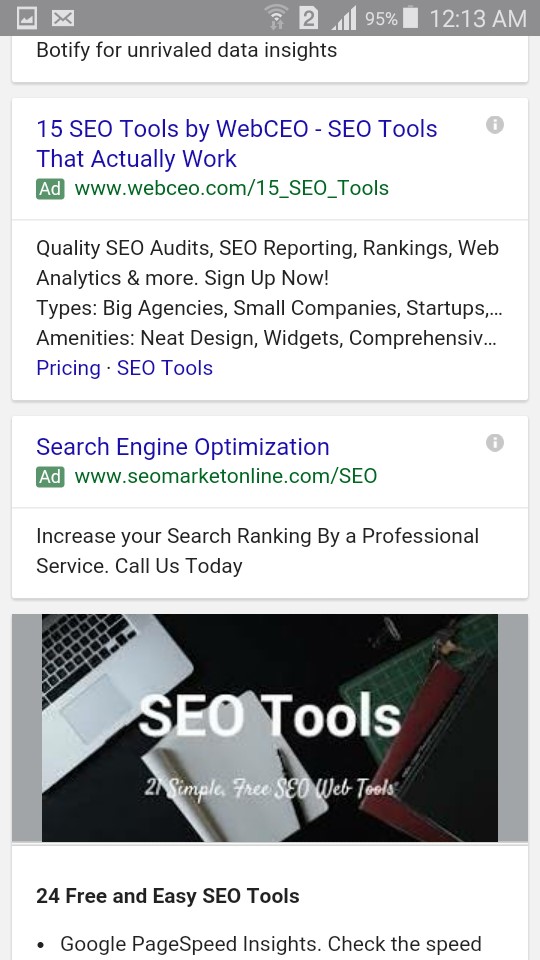

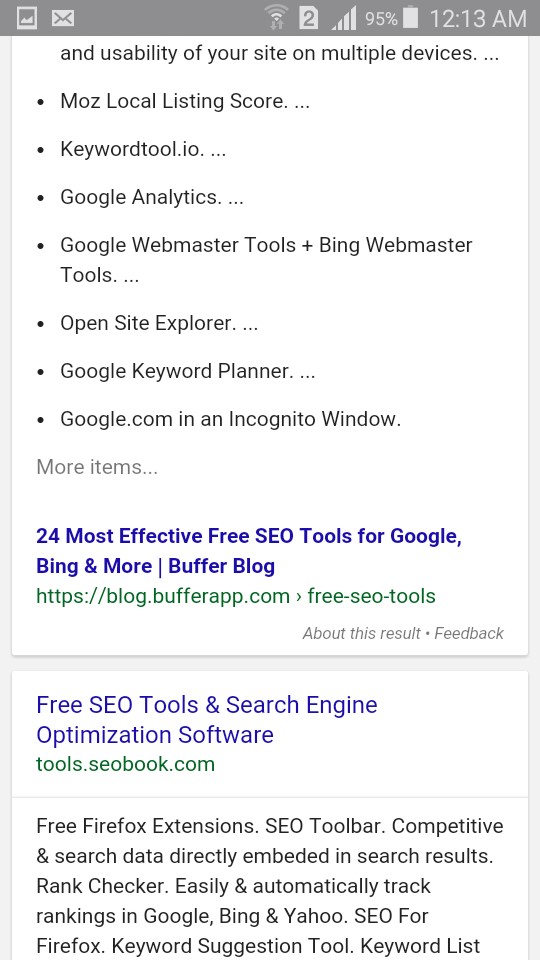

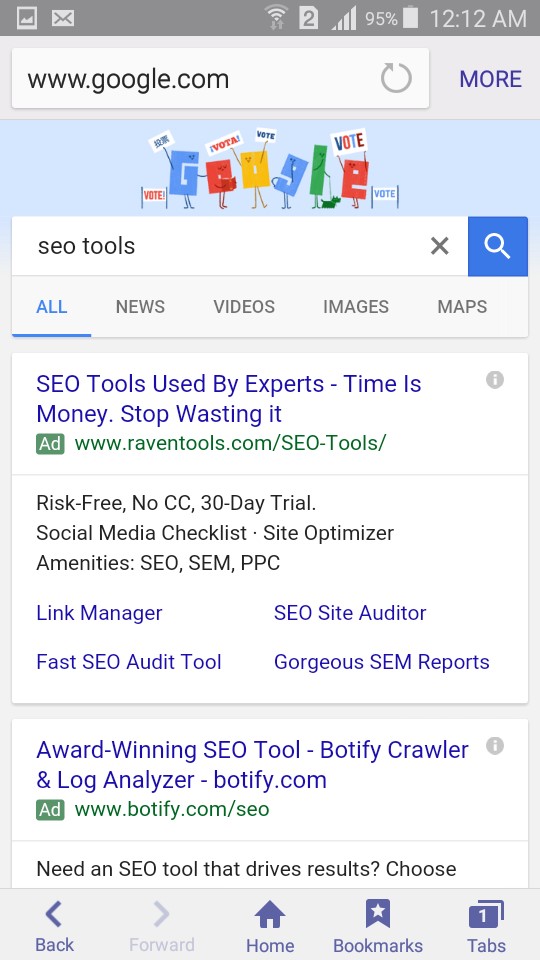

As bad as either of the above looks in terms of ad load or result diversity on the desktop, it is only worse on mobile.

On mobile devices organic search results can be so hard to find that people ask questions like “Are there any search engines where you don’t have to literally scroll to see a result that isn’t an advertisement?“

The answer is yes.

But other than that, it is slim pickings.

In an online ecosystem where virtually every innovation is copied or deemed spam, sustainable publishing only works if your business model is different than the central network operators.

Not only is there the aggressive horizontal ad layer for anything with a hint of commercial intent, but now the scrape layer which was first applied to travel is being spread across other categories like ecommerce.

Ecommerce retailers beware. There is now a GIANT knowledge panel result on mobile that takes up the entire top half of the SERP -> Google updates mobile product knowledge panels to show even more info in one spot: https://t.co/3JMsMHuQmJ pic.twitter.com/5uD8zZiSrK— Glenn Gabe (@glenngabe) November 14, 2017

Here are 2 examples. And alarms are going off at Amazon now. Yes, Prime is killer, but organic search traffic is going to tank. Go ahead & scroll down to the organic listings (if you dare).And if anyone clicks the module, they are taken away from the SERPs into G-Land. Wow. :) pic.twitter.com/SswOPj4iGd— Glenn Gabe (@glenngabe) November 14, 2017

The more of your content Google can scrape-n-displace in the search results the less reason there is to visit your website & the more ad-heavy Google can make their interface because they shagged the content from your site.

Simply look at the market caps of the big tech monopolies vs companies in adjacent markets. The aggregate trend is expressed in the stock price. And it is further expressed in the inability for the unicorn media companies to go public.

As big as Snapchat & Twitter are, nobody who invested in either IPO is sitting on a winner today.

Google is outraged anyone might question the numbers & if the current set up is reasonable:

Mr Harris described as “factually incorrect” suggestions that Google was “stealing” ad revenue from publishers, saying that two thirds of the revenues generated by online content went to its originators.

“I’ve heard lots of people say that Google and Facebook are “ruthlessly stealing” all the advertising revenue that publishers hoped to acquire through online editions,” he told the gathering.

“There is no advertising on Google News. Zero. Indeed you will rarely see advertising around news cycles in Google Search either.

Sure it is not the ad revenues they are stealing.

Rather it is the content.

Either by scraping, or by ranking proprietary formats (AMP) above other higher quality content which is not published using the proprietary format & then later attaching crappier & crappier deals to the (faux) “open source” proprietary content format.

As Google grabs the content & cuts the content creator off from the audience while attaching conditions, Google’s PR hacks will tell you they want you to click through to the source:

Google spokeswoman Susan Cadrecha said the company’s goal isn’t to do the thinking for users but “to help you find relevant information quickly and easily.” She added, “We encourage users to understand the full context by clicking through to the source.”

except they are the ones adding extra duplicative layers which make it harder to do.

Google keeps extracting content from publishers & eating the value chain. Some publishers have tried to offset this by putting more ads on their own site while also getting further distribution by adopting the proprietary AMP format. Those who realized AMP was garbage in terms of monetization viewed it as a way to offer teasers to drive users to their websites.

The partial story approach is getting killed though. Either you give Google everything, or they want nothing.

That is, after all, how monopolies negotiate – ultimatums.

Those who don’t give Google their full content will soon receive manual action penalty notifications

Important: Starting 2/1/18, Google is requiring that AMP urls be comparable to the canonical page content. If not, Google will direct users to the non-AMP urls. And the urls won’t be in the Top Stories carousel. Site owners will receive a manual action: https://t.co/ROhbI6TMVz pic.twitter.com/hb9FTluV0S— Glenn Gabe (@glenngabe) November 16, 2017

The value of news content is not zero.

Being the go-to resource for those sorts of “no money here” news topics also enables Google to be the go-to resource for searches for [auto insurance quote] and other highly commercial search terms where Google might make $50 or $100 per click.

Every month Google announces new ad features.

Economics drive everything in publishing. But you have to see how one market position enables another. Google & Facebook are not strong in China, so Toutiao – the top news app in China – is valued at about $20 billion.

Now that Yahoo! has been acquired by Verizon, they’ve decided to shut down their news app. Unprofitable segments are worth more as a write off than as an ongoing concern. Look for Verizon to further take AIM at shutting down additional parts of AOL & Yahoo.

Firefox recently updated to make its underlying rendering engine faster & more stable. As part of the upgrade they killed off many third party extensions, including ours. We plan to update them soon (a few days perhaps), but those who need the extensions working today may want to install something like (Comodo Dragon (or another browser based on the prior Firefox core) & install our extensions in that web browser.

As another part of the most recent Firefox update, Firefox dumped Yahoo! Search for Google search as their default search engine in a new multiyear deal where financial terms were not disclosed.

Yahoo! certainly deserved to lose that deal.

First, they signed a contract with Mozilla containing a change-of-ownership poison pill where Mozilla would still make $375 million a year from them even if they dump Yahoo!. Given what Yahoo! sold for this amounts to about 10% of the company price for the next couple years.

Second, Yahoo! overpaid for the Firefox distribution deal to where they had to make their user experience even more awful to try to get the numbers to back out.

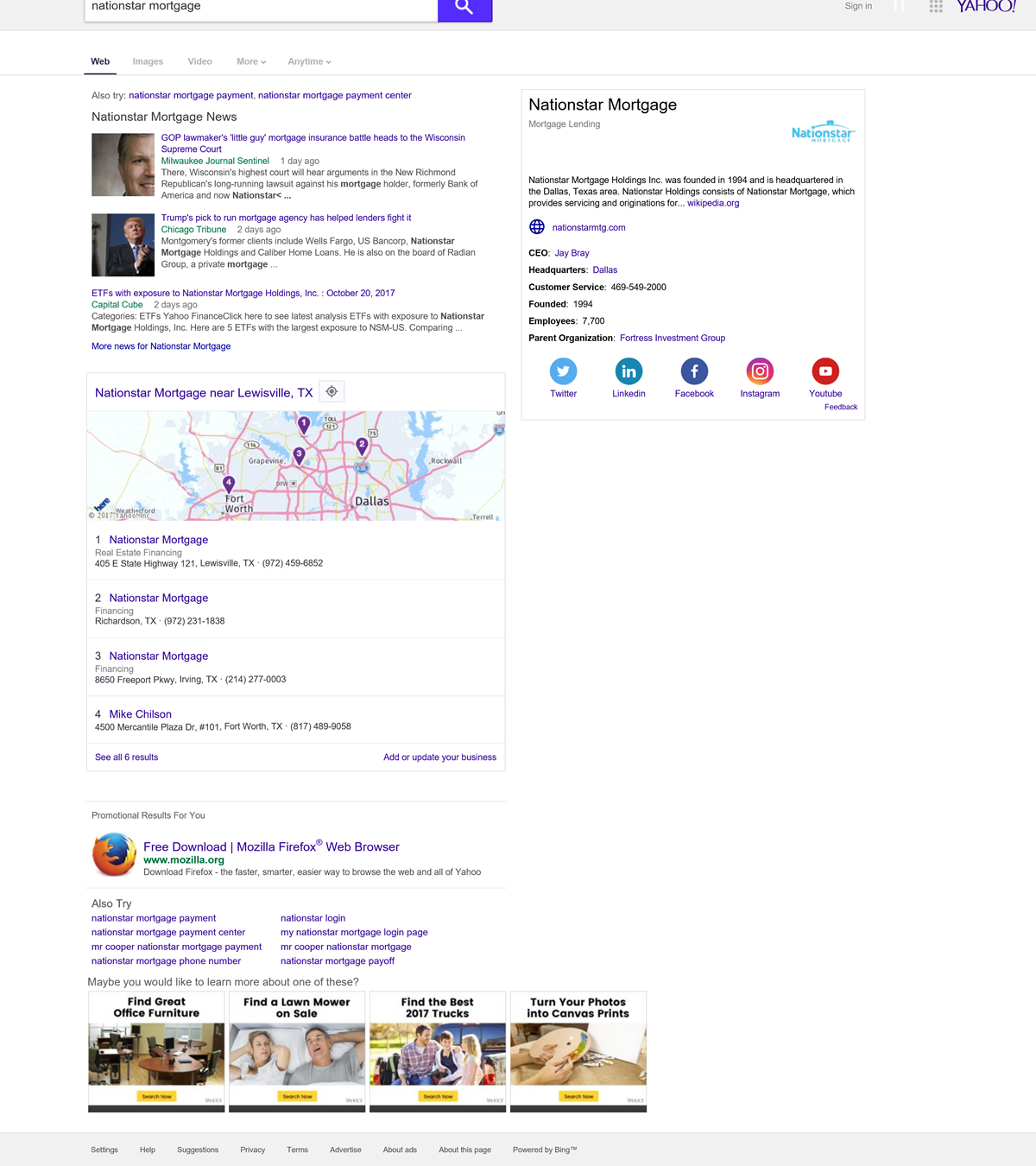

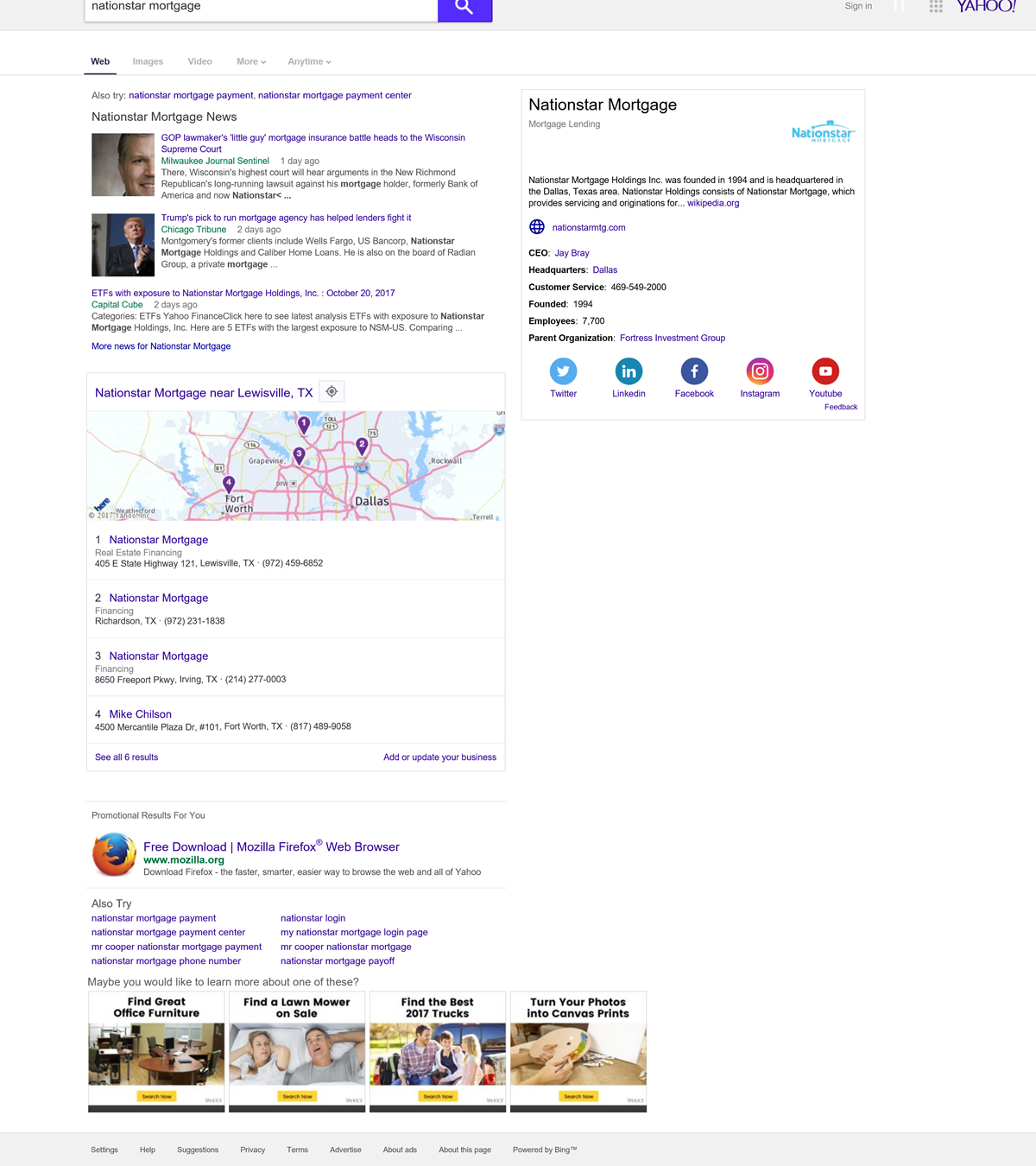

Here is a navigational search result on Yahoo! where the requested site only appears in the right rail knowledge graph.

The “organic” result set has been removed. There’s a Yahoo! News insert, a Yahoo Local insert, an ad inviting you to download Firefox (bet that has since been removed!), other search suggestions, and then graphical ads to try to get you to find office furniture or other irrelevant stuff.

Here is how awful those sorts of search results are: Yahoo! was so embarrassed at the lack of quality of their result set that they put their logo at the upper right edge of the page.

So now they’ll be losing a million a day for a few years based on Marissa Mayer’s fantastic Firefox deal.

And search is just another vertical they made irrelevant.

When they outsourced many verticals & then finally shut down most of the remaining ones, they only left a few key ones:

On our recent earnings call, Yahoo outlined out a plan to simplify our business and focus our effort on our four most successful content areas – News, Sports, Finance and Lifestyle. To that end, today we will begin phasing out the following Digital Magazines: Yahoo Food, Yahoo Health, Yahoo Parenting, Yahoo Makers, Yahoo Travel, Yahoo Autos and Yahoo Real Estate.

And for the key verticals they kept, they have pages like the following, which look like a diet version of eHow

Every day they send users away to other sites with deeper content. And eventually people find one they like (like TheAthletic or Dunc’d On) & then Yahoo! stops being a habit.

Meanwhile many people get their broader general news from Facebook, Google shifted their search app to include news, Apple offers a great news app, the default new tab on Microsoft Edge browser lists a localize news feed. Any of those is a superior user experience to Yahoo!.

It is hard to see what Yahoo!’s role is going forward.

Other than the user email accounts (& whatever legal liabilities are associated with the chronic user account hacking incidents), it is hard to see what Verizon bought in Yahoo!.

Left is Right & Up is Down

Probably the single best video to watch to understand the power of Google & Facebook (or even most of the major problems across society) is this following video about pleasure versus happiness.

In constantly seeking pleasure we forego happiness.

The “feed” based central aggregation networks are just like slot machines in your pocket: variable reward circuitry which self-optimizes around exploiting your flaws to eat as much attention as possible.

The above is not an accident. It is, rather, as intended:

“That means that we needed to sort of give you a little dopamine hit every once in a while because someone liked or commented on a photo or a post or whatever … It’s a social validation feedback loop … You’re exploiting a vulnerability in human psychology … [The inventors] understood this, consciously, and we did it anyway.”

- Happy? Good! Share posed photos to make your friends feel their lives are worse than your life is.

- Outraged? Good! Click an ad.

- Hopeless? Good. There is a product which can deliver you pleasure…if only you can…click an ad.

Using machine learning to drive rankings is ultimately an exercise in confirmation bias:

For “Should abortion be legal?” Google cited a South African news site saying, “It is not the place of government to legislate against woman’s choices.”

When asked, “Should abortion be illegal?” it promoted an answer from obscure clickbait site listland.com stating, “Abortion is murder.”

Excellent work Google in using your featured snippets to help make the world more absolutist, polarized & toxic.

The central network operators not only attempt to manipulate people at the emotional level, but the layout of the interface also sets default user patterns.

Most users tend to focus their attention on the left side of the page: “if we were to slice a maximized page down the middle, 80% of the fixations fell on the left half of the screen (even more than our previous finding of 69%). The remaining 20% of fixations were on the right half of the screen.”

This behavior is even more prevalent on search results pages: “On SERPs, almost all fixations (94%) fell on the left side of the page, and 60% those fixations can be isolated to the leftmost 400px.”

On mobile, obviously, the attention is focused on what is above the fold. That which is below the fold sort of doesn’t even exist for a large subset of the population.

Outside of a few central monopoly attention merchant players, the ad-based web is dying.

Mashable has raised about $46 million in VC funding over the past 4 years. And they just sold for about $50 million.

Breaking even is about as good as it gets in a web controlled by the Google / Facebook duopoly. :D

Other hopeful unicorn media startups appear to have peaked as well. That BuzzFeed IPO is on hold: “Some BuzzFeed investors have become worried about the company’s performance and rising costs for expansions in areas like news and entertainment. Those frustrations were aired at a board meeting in recent weeks, in which directors took management to task, the people familiar with the situation said.”

Google’s Chrome web browser will soon have an ad blocker baked into it. Of course the central networks opt out of applying this feature to themselves. Facebook makes serious coin by blocking ad blockers. Google pays Adblock Plus to unblock ads on Google.com & boy are there a lot of ads there.

Format your pages like Google does their search results and they will tell you it is a piss poor user experience & a form of spam – whacking you with a penalty for it.

Of course Google isn’t the only search engine doing this. Mix in ads with a double listing and sometimes there will only be 1 website listed above the fold.

I’ve even seen some Bing search results where organic results have a “Web” label on them – which is conveniently larger than the ad label that is on ads. That is in addition to other tricks like…

- lots of ad extensions that push organics below the fold on anything with the slightest commercial intent

- bolding throughout ads (title, description, URL) with much lighter bolding of organics

- only showing 6 organic results on commercial searches that are likely to generate ad clicks

As bad as either of the above looks in terms of ad load or result diversity on the desktop, it is only worse on mobile.

On mobile devices organic search results can be so hard to find that people ask questions like “Are there any search engines where you don’t have to literally scroll to see a result that isn’t an advertisement?“

The answer is yes.

But other than that, it is slim pickings.

In an online ecosystem where virtually every innovation is copied or deemed spam, sustainable publishing only works if your business model is different than the central network operators.

Not only is there the aggressive horizontal ad layer for anything with a hint of commercial intent, but now the scrape layer which was first applied to travel is being spread across other categories like ecommerce.

Ecommerce retailers beware. There is now a GIANT knowledge panel result on mobile that takes up the entire top half of the SERP -> Google updates mobile product knowledge panels to show even more info in one spot: https://t.co/3JMsMHuQmJ pic.twitter.com/5uD8zZiSrK— Glenn Gabe (@glenngabe) November 14, 2017

Here are 2 examples. And alarms are going off at Amazon now. Yes, Prime is killer, but organic search traffic is going to tank. Go ahead & scroll down to the organic listings (if you dare).And if anyone clicks the module, they are taken away from the SERPs into G-Land. Wow. :) pic.twitter.com/SswOPj4iGd— Glenn Gabe (@glenngabe) November 14, 2017

The more of your content Google can scrape-n-displace in the search results the less reason there is to visit your website & the more ad-heavy Google can make their interface because they shagged the content from your site.

Simply look at the market caps of the big tech monopolies vs companies in adjacent markets. The aggregate trend is expressed in the stock price. And it is further expressed in the inability for the unicorn media companies to go public.

As big as Snapchat & Twitter are, nobody who invested in either IPO is sitting on a winner today.

Google is outraged anyone might question the numbers & if the current set up is reasonable:

Mr Harris described as “factually incorrect” suggestions that Google was “stealing” ad revenue from publishers, saying that two thirds of the revenues generated by online content went to its originators.

“I’ve heard lots of people say that Google and Facebook are “ruthlessly stealing” all the advertising revenue that publishers hoped to acquire through online editions,” he told the gathering.

“There is no advertising on Google News. Zero. Indeed you will rarely see advertising around news cycles in Google Search either.

Sure it is not the ad revenues they are stealing.

Rather it is the content.

Either by scraping, or by ranking proprietary formats (AMP) above other higher quality content which is not published using the proprietary format & then later attaching crappier & crappier deals to the (faux) “open source” proprietary content format.

As Google grabs the content & cuts the content creator off from the audience while attaching conditions, Google’s PR hacks will tell you they want you to click through to the source:

Google spokeswoman Susan Cadrecha said the company’s goal isn’t to do the thinking for users but “to help you find relevant information quickly and easily.” She added, “We encourage users to understand the full context by clicking through to the source.”

except they are the ones adding extra duplicative layers which make it harder to do.

Google keeps extracting content from publishers & eating the value chain. Some publishers have tried to offset this by putting more ads on their own site while also getting further distribution by adopting the proprietary AMP format. Those who realized AMP was garbage in terms of monetization viewed it as a way to offer teasers to drive users to their websites.

The partial story approach is getting killed though. Either you give Google everything, or they want nothing.

That is, after all, how monopolies negotiate – ultimatums.

Those who don’t give Google their full content will soon receive manual action penalty notifications

Important: Starting 2/1/18, Google is requiring that AMP urls be comparable to the canonical page content. If not, Google will direct users to the non-AMP urls. And the urls won’t be in the Top Stories carousel. Site owners will receive a manual action: https://t.co/ROhbI6TMVz pic.twitter.com/hb9FTluV0S— Glenn Gabe (@glenngabe) November 16, 2017

The value of news content is not zero.

Being the go-to resource for those sorts of “no money here” news topics also enables Google to be the go-to resource for searches for [auto insurance quote] and other highly commercial search terms where Google might make $50 or $100 per click.

Every month Google announces new ad features.

Economics drive everything in publishing. But you have to see how one market position enables another. Google & Facebook are not strong in China, so Toutiao – the top news app in China – is valued at about $20 billion.

Now that Yahoo! has been acquired by Verizon, they’ve decided to shut down their news app. Unprofitable segments are worth more as a write off than as an ongoing concern. Look for Verizon to further take AIM at shutting down additional parts of AOL & Yahoo.